Good morning. During the Dot-Com Crash (2000–2002), the NASDAQ fell nearly 78% from its peak, wiping out trillions in market value. Companies with no profits, no product, and sometimes no business plan had been trading like they were the future.

When the bubble burst, reality did what reality always does, it repriced everything.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

FOREX

The Real Move Isn’t Happening Yet

Today feels like one of those quiet, waiting moments in the market.

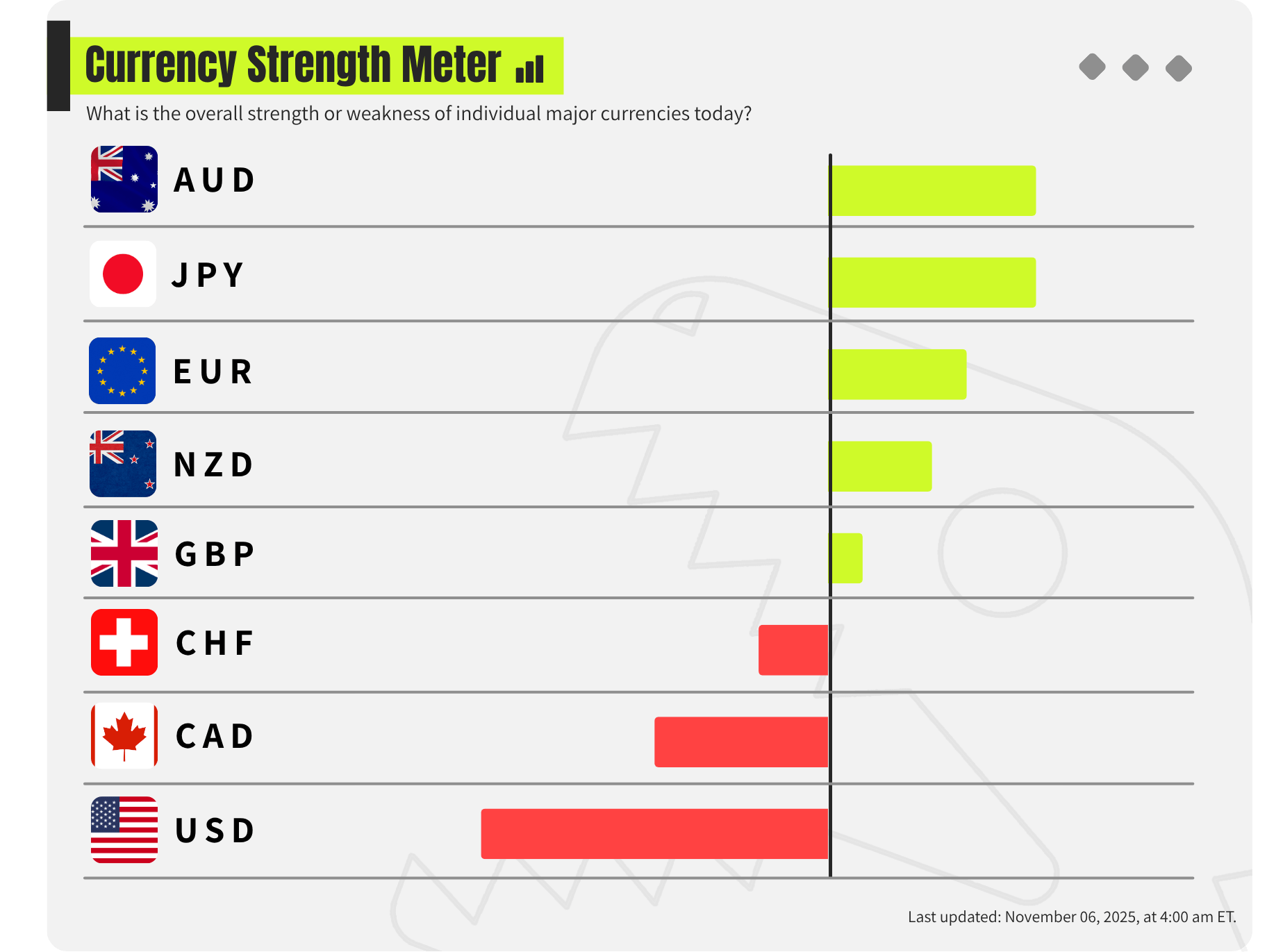

The U.S. Dollar is taking a small step back from recent highs, and risk currencies like AUD and NZD are getting a brief lift. But nothing big has changed yet, this is just the market resetting before the next move.

The focus now is on the Bank of England later today, and traders are simply positioning themselves ahead of it.

Let’s break down what’s really happening.

Here’s What You Need to Know

1. The Dollar Pulled Back on Market Mood

The dollar eased a bit, not because of bad data, but because markets calmed down. Stocks found support after recent selling, and that gave traders a reason to move slightly out of the dollar and into risk currencies. It’s a pause, not a reversal.

2. AUD and NZD Got a Bounce, But It’s Not a Trend

AUD lifted off the 200-day moving average near 0.6510, and NZD moved away from recent lows. This move comes from improved risk appetite, not strong fundamentals. If sentiment turns again, these pairs can easily slip back down.

3. USD/JPY Still Holds Firm Because of Yield

Even with the softer dollar, USD/JPY is holding around 153.90. With the U.S. government shutdown delaying fresh economic data, traders are relying on what’s already known: U.S. yields are still higher than Japan’s. That keeps a floor under USD/JPY.

4. Sterling Is Waiting for the BoE Tone

The BoE is expected to hold rates at 4.0%, but the tone matters more than the rate. If the message leans dovish (hinting cuts soon), GBP could soften again. GBP/USD sitting near 1.3050 suggests traders are waiting to react, not guessing.

My Takeaway

This is not a day for aggressive trading. It’s a watch-and-listen day.

The dollar’s pullback can be temporary. AUD and NZD are bouncing on mood, not strength at the moment and GBP is holding until the BoE speaks.

Our edge today is patience. The real move comes after the announcement not before it.

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

LEARN

BoE Rate Decision. What It Means for Traders

All eyes will be on the Bank of England at 12pm GMT today.

The likelihood is that the central bank will hold rates at 4%, but it;s the forward guidance we will need to look out for.

Recent BoE Communications

In its latest communications, the BoE has adopted a neutral tone, emphasizing that inflation “remains not out of the woods” while growth concerns are mounting.

Inflation in the UK remained at 3.8% in September, well above the 2% target.

The Autumn Budget (scheduled 26 November) will play a role: reports suggest fiscal tightening (tax increases) could reduce demand, which eases rate-cut pressure.

Future Guidance

If the BoE emphasises “more slack required”, “weak growth” or “ready to ease” that would be a dovish signal.

If the BoE emphasises “inflation risk”, “real-term rates still restrictive”, or “waiting for data” that could be a hawkish/neutral signal.

It is also important to keep an eye on the MPC vote. If more members lean towards cuts it could highlight what is to come.

Trading Takeaway for Retail Traders

If you’re trading this meeting I would be very cautious.

In my opinion I will be looking to sell GBP on any significant rallies, as I believe the BoE will have to cut soon.

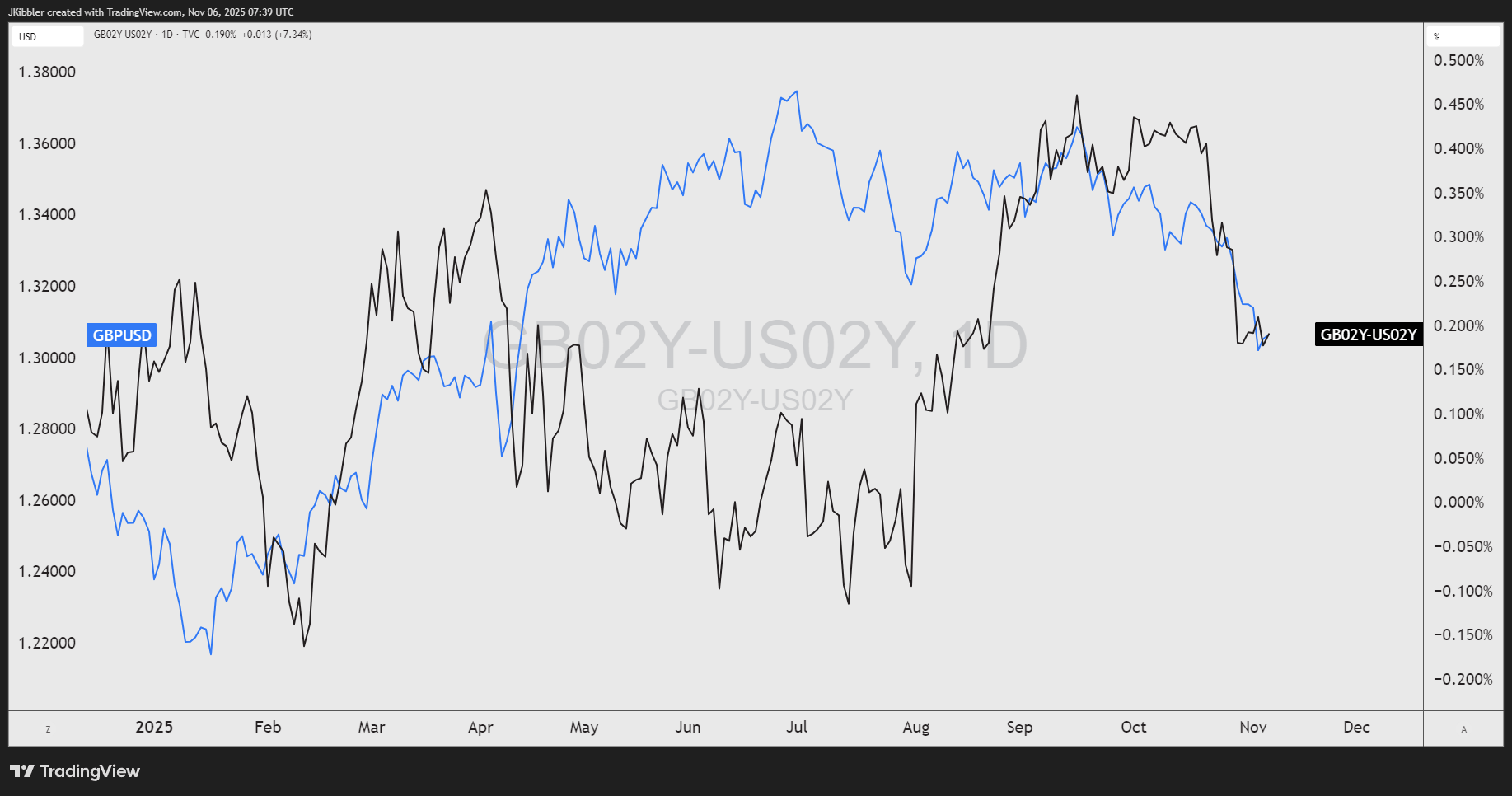

Looking into the interest rate differentials between the 2yr Gilts and US bond yields we can see it has a strong correlation with price at the moment. This will be something to watch out for.

There will be some unknown this meeting and it will be likely that the central bank looks at the risks of the upcoming budget as an excuse to hold and wait.

CHART BREAKDOWN OF THE DAY (NZD/USD)

NZD/USD continues to push lower, trading around the 0.5660 zone. The structure remains bearish, with price holding below both the 50-day and 200-day moving averages. If 0.5550 breaks, the next downside magnet sits at 0.5490. Bulls would need to reclaim 0.5820 to challenge any meaningful reversal.

DAILY TRADING PSYCHOLOGY NUGGET

“Consistency is a superpower in trading.” One good trade means nothing if the next five are emotional. Your edge only shows when you repeat disciplined decisions over and over not just when the market feels easy.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 06, 2025)

credits: REUTERS/Manami Yamada/File Photo

Global equity markets are rallying on signs of economic resilience, especially in the U.S., even as higher yields and policy uncertainty keep risk sentiment cautiously optimistic. Asian shares rebounded after recent losses, the dollar steadied near multi-month highs, and investors remain wary of stretched valuations and interest-rate risks. (source:reuters)

GAMES

Trading Brain Training

I’m pain for bears when price runs high,

Borrowed shares vanish, bids fly.

Cover fast or feel the squeeze

One runaway candle brings you to your knees.

What Am I?

GET TO IT

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Short Squeeze