Good morning. Around 78% of the world’s annual gold demand comes from the jewelry industry, not central banks or traders. That means global fashion trends can quietly influence the price of the “ultimate safe-haven” asset.

Gold isn’t just in vaults, it’s also around necks and wrists, moving markets in style.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

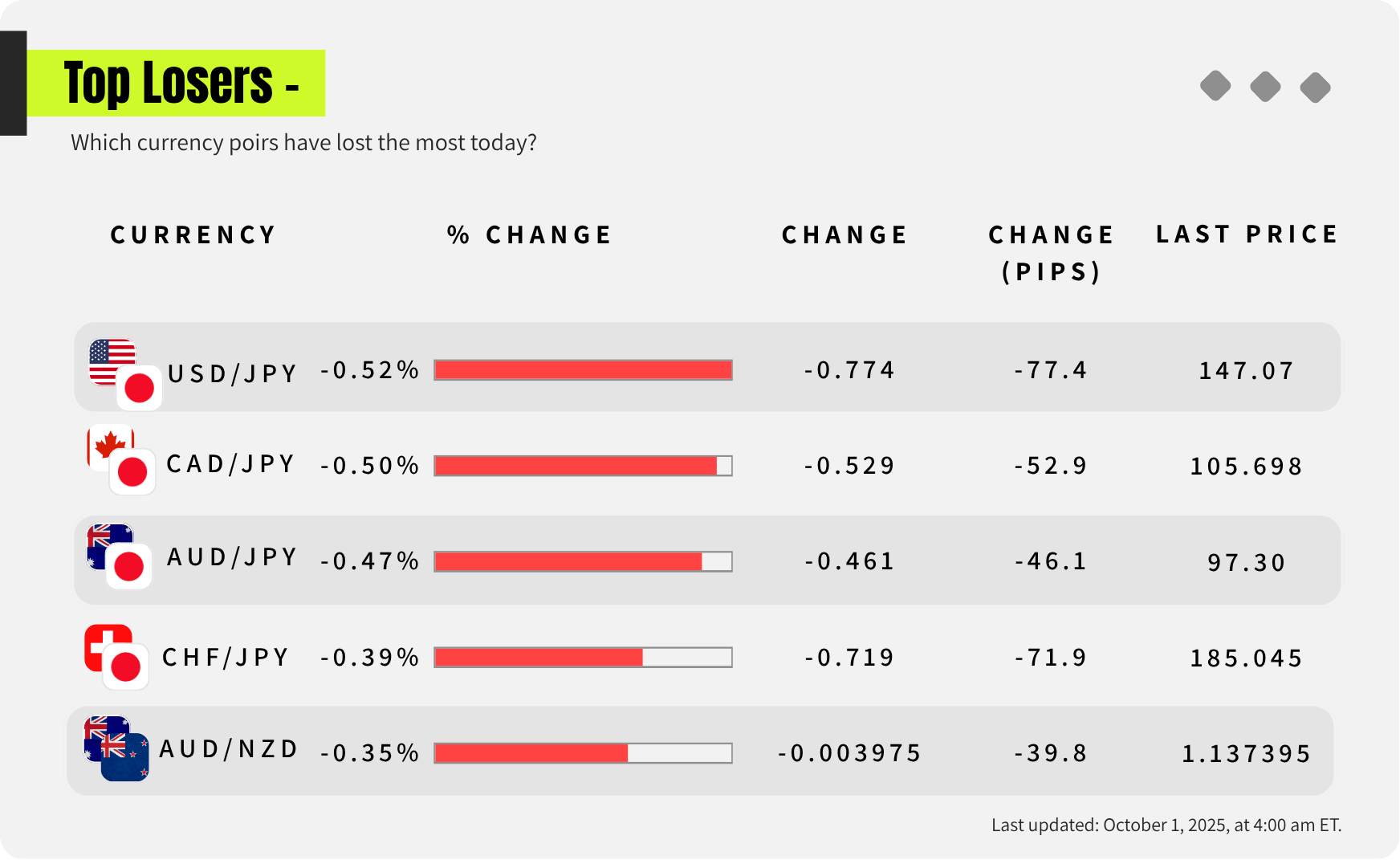

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

Gold Breaks $3,850 and Isn’t Slowing Down

There’s something different about watching gold carve out new highs. Seeing it smash through $3,850 felt less like hype and more like a market finally revealing its hand.

This isn’t just about traders chasing momentum, it’s about a shift in confidence that’s been building for months. Between the politics in Washington, Fed uncertainty, and central banks hoarding bullion, gold’s rally is the kind you can’t ignore.

Here’s what you need to know:

1. The Break Above $3,850

The $3,800 level was a wall for weeks, but once it broke that and the $3,850 level, the floodgates opened. Gold is now pushing toward $3,870, and every shallow pullback since late September shows the same story: dip-buyers are stepping in aggressively. What used to be resistance at $3,800 is now acting as fresh support.

2. Technical Structure Still Bullish

Looking at the chart, the uptrend is intact with higher highs and higher lows. Support sits near $3,800, $3,700 and $3,635, with a deeper cushion down around $3,433 if momentum cools.

On the upside, $3,900 is the next target, and a clean daily close above that opens the door to $3,950 or even $4,000. This isn’t a market rolling over; it’s one consolidating on the way up.

3. Fundamentals Are Lining Up

The rally isn’t just technical. A weaker U.S. dollar is fueling the push, weighed down by political wrangling over a potential government shutdown and constant questions around Fed independence. Add to that steady central bank demand and geopolitical tensions, and gold has a safety bid that’s hard to fade.

4. Momentum and Conviction

The key here is conviction. Every retracement has been shallow, more like pauses than reversals. That shows buyers aren’t rushing for the exits, they’re adding on dips. With gold already up nearly 45% this year, that kind of sustained demand signals this move isn’t just noise.

My Takeaway

Breaking $3,850 isn’t the end of gold’s story, it’s the next chapter. The mix of fundamentals and technicals gives this rally real staying power.

Could we see profit-taking? Absolutely.

But unless gold loses $3,800 decisively, the trend is still higher. For us traders, that means treating dips as opportunities, not warnings. In this game, conviction and structure matter more than headlines and right now, gold has both.

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

TRADER INSIGHTS

New Month, New Moves: Refresh, Reset & Refocus

As retail traders, we often get caught up in the day-to-day noise, bouncing from one setup to the next, riding the high of a win or the frustration of a loss.

But a new month offers the perfect excuse to zoom out, check your bearings, and reassess where the real opportunities lie.

1. Look Back Before You Look Forward

Start with a quick review of last month:

What pairs or markets trended?

Where did you perform well, and where did you force trades?

Any repeating mistakes worth noting?

Don’t just scroll past your losses. That one trade you wish you hadn’t taken? That’s probably where your next level of growth is hiding.

2. Fresh Fundamentals, New Macro Themes

A new month means a fresh round of:

Central bank decisions

CPI data

Quarterly earnings (for those watching indices)

This is where the big shifts happen. Be ready for narrative changes.

Ask yourself the question: is the market still obsessed with inflation? Is growth data starting to matter more?

These are the breadcrumbs that point to new macro trades.

3. Rebuild the Watchlist

Start with a clean chart and ask:

Where are the cleanest trends forming now?

Which currencies or assets are showing clear strength or weakness?

What seasonal or fundamental themes could come into play?

Even just 2-3 strong watchlist ideas is more than enough. Don’t overload yourself.

Feel Fresh

New month, new market. Instead of chasing what’s already played out, take the time to reset, reframe, and refocus on where the next opportunities are hiding.

This is your chance to be the trader who’s prepared, not the one reacting when it’s already too late.

Good Luck!

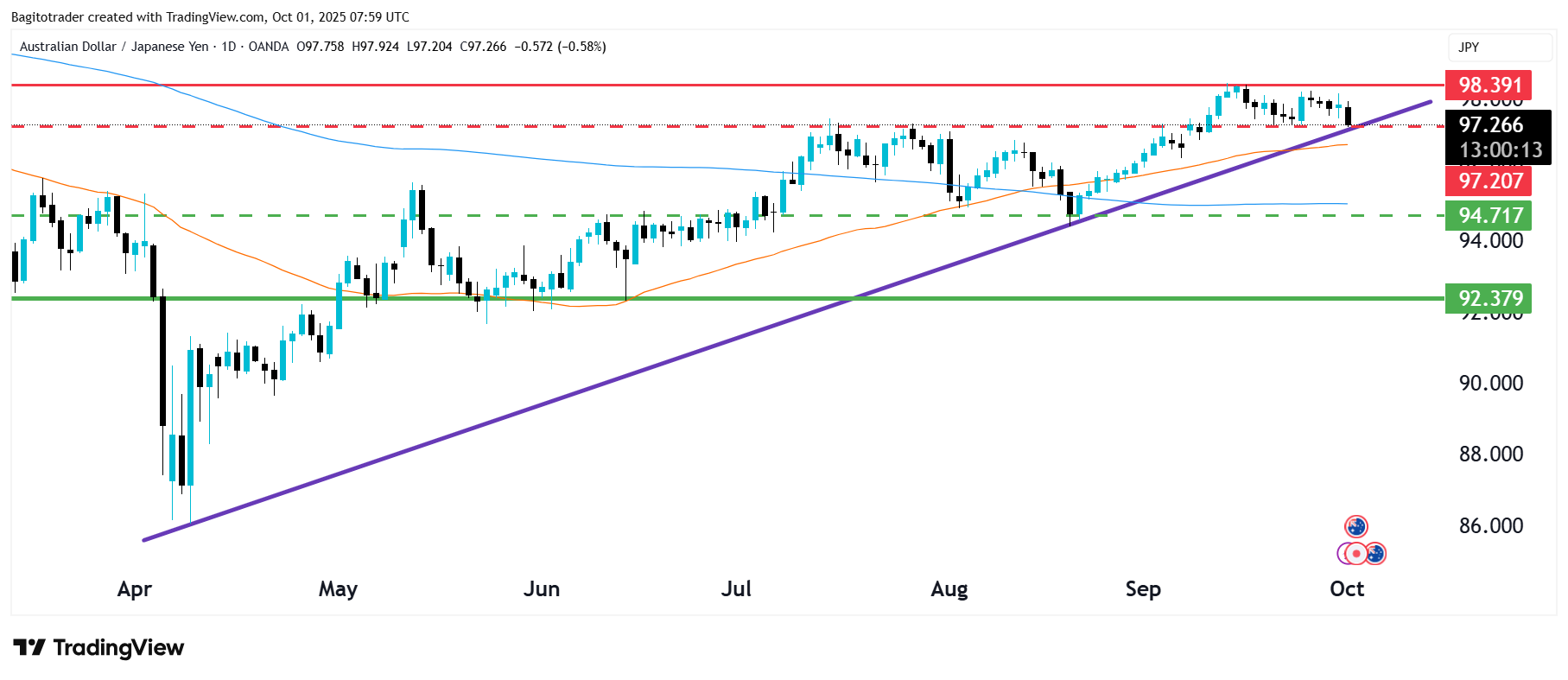

CHART BREAKDOWN OF THE DAY (AUD/JPY)

AUD/JPY is holding near 97.25, sitting right on its rising trendline after multiple rejections around the 98.40 resistance zone. The pair remains in an overall uptrend, supported by higher lows and the 50-day SMA, but momentum has slowed under heavy resistance. A bounce from this level could fuel another push toward 98.40–98.80, while a clean break below 97.20 would expose downside risks toward 94.70 and potentially 92.40.

DAILY TRADING PSYCHOLOGY NUGGET

“Cut your losses short and let your winners run.” Most traders flip this around, holding onto losers out of hope and closing winners out of fear. Mastering this reversal is one of the simplest yet hardest disciplines that separates consistent traders from the rest.

- Jesse Livermore

TODAY’S MOST TRENDING MARKET NEWS (OCTOBER 1, 2025)

credits: Brendan McDermid/reuters

U.S. stock futures slipped and gold hit a fresh record as the U.S. government officially shut down, threatening delays in key economic data like the non-farm payrolls report. Without those indicators, markets are grappling with heightened uncertainty about the timing of future Fed moves. (source: reuters)

GAMES

Trading Brain Training

I don’t chase price, I wait my turn,

Set at a level where I’ll earn.

Fill me or kill me, calm, not rash,

I buy or sell without a splash.

What Am I?

GET TO IT

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Limit Order