Good morning. The economic calendar we follow today traces back to 1917, when the U.S. started releasing data on fixed schedules to prevent insider advantage.

Before that, traders relied on rumors and early leaks, which is why set times like CPI at 8:30 ET and NFP every first Friday became the standard for fair markets.

-Jonathan Kibbler, Shaun A, Jordon Mellor

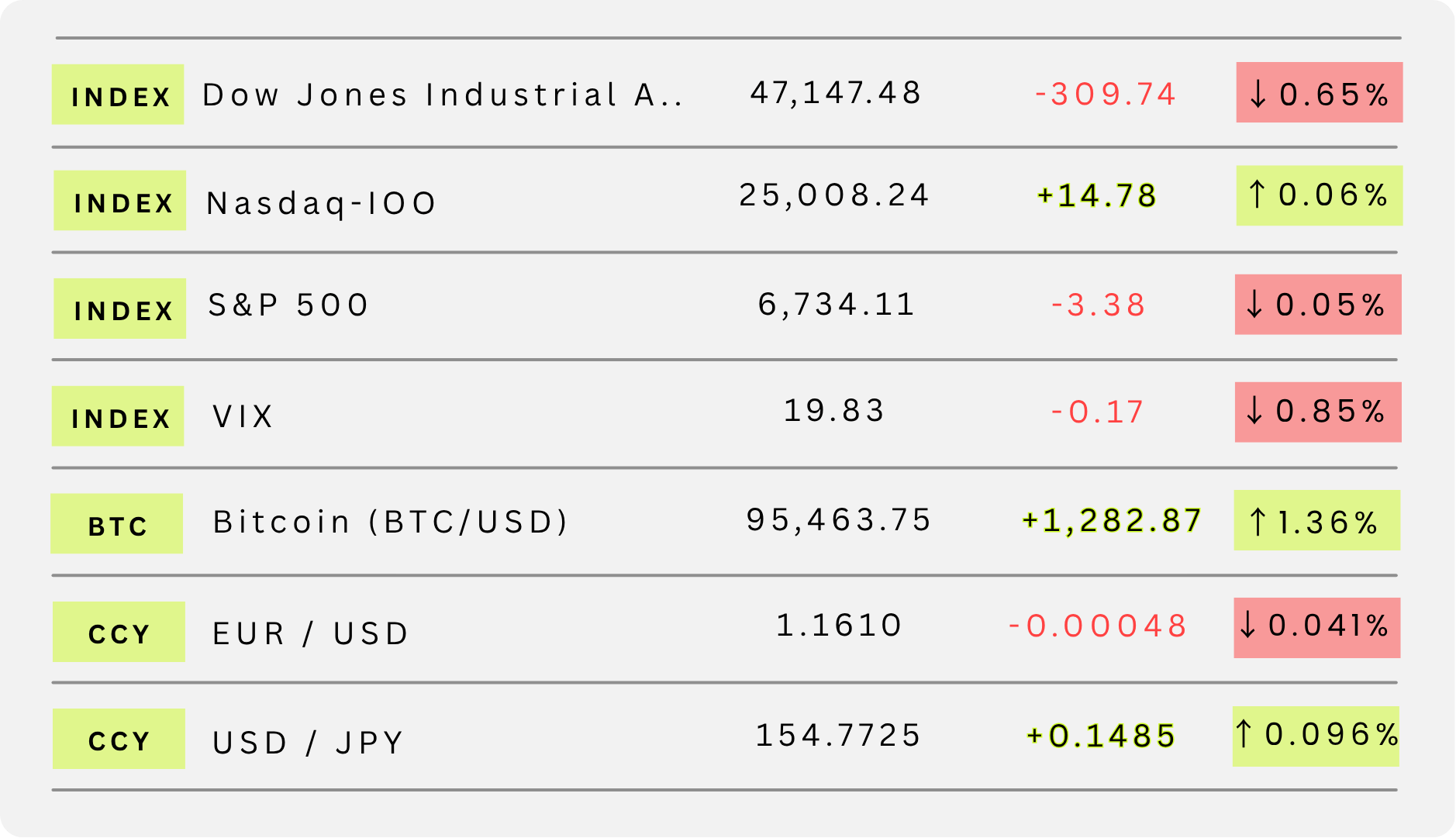

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

GOLD CHART BREAKDOWN OF THE DAY

Gold is stuck under a clear 15m downtrend line after last session’s sharp drop. Bulls are trying to hold the 4,083 support, but momentum is still leaning bearish as long as price stays below 4,109 and the descending trendline.

MARKET ANALYSIS

A Heavy Week for Traders

This week isn’t starting slow, it’s loaded. We’ve got inflation numbers from Canada, wage data from Australia, UK CPI mid-week, and a big U.S. lineup that includes FOMC minutes, jobs data, and PMI prints.

If last week was filled with uncertainty, this week is all about clarity. The market finally gets the data it’s been waiting for, and that means price action should start making more sense.

Here’s What You Need to Know:

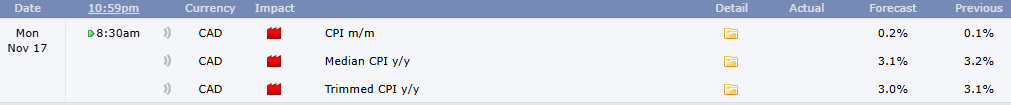

1. Canada Kicks Things Off With CPI (Monday)

CAD is in the spotlight early with three inflation prints, headline, median, and trimmed CPI. Forecasts point to steady or slightly stronger inflation. If CPI holds firm, it supports the idea that the Bank of Canada won’t rush into cuts. We can expect volatility on CAD pairs around the release.

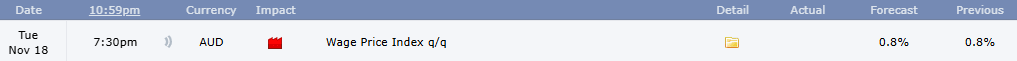

2. Australia Brings Wage Data (Tuesday)

AUD gets tested with the Wage Price Index. Strong wages = sticky inflation = RBA staying tight. A weak number, though, opens the door for rate-cut talk. AUD has been fragile lately, so this print matters.

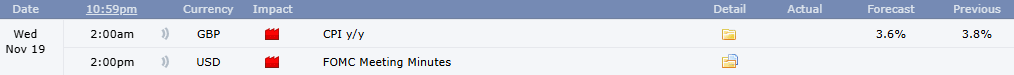

3. UK CPI Takes Center Stage (Wednesday)

GBP reacts strongly to inflation data, and this week will be no different. CPI is expected to cool a bit from 3.8% to 3.6%. If the drop is bigger, rate-cut expectations for the Bank of England will jump and GBP could slip quickly.

4. The U.S. Brings the Heat (Thursday–Friday)

This is where the real momentum comes in.

– Thursday: Average hourly earnings, Non-Farm Employment Change, and the unemployment rate.

– Friday: Flash Manufacturing and Services PMIs.

After weeks of delayed data, markets finally get a clearer look at the U.S. economy. If jobs stay soft and PMIs weaken, rate-cut bets for early 2026 grow.

My Takeaway

This week will reveal what the market really thinks.

Last week was about waiting, this one is about reacting, at least for me.

If you’re trading today, keep your expectations grounded. Monday sets the mood, but the real moves come mid-week once the big data drops.

You guys already know it, the best setups arrive when the numbers start talking.

Put Interest On Ice Until 2027

Pay no interest until 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

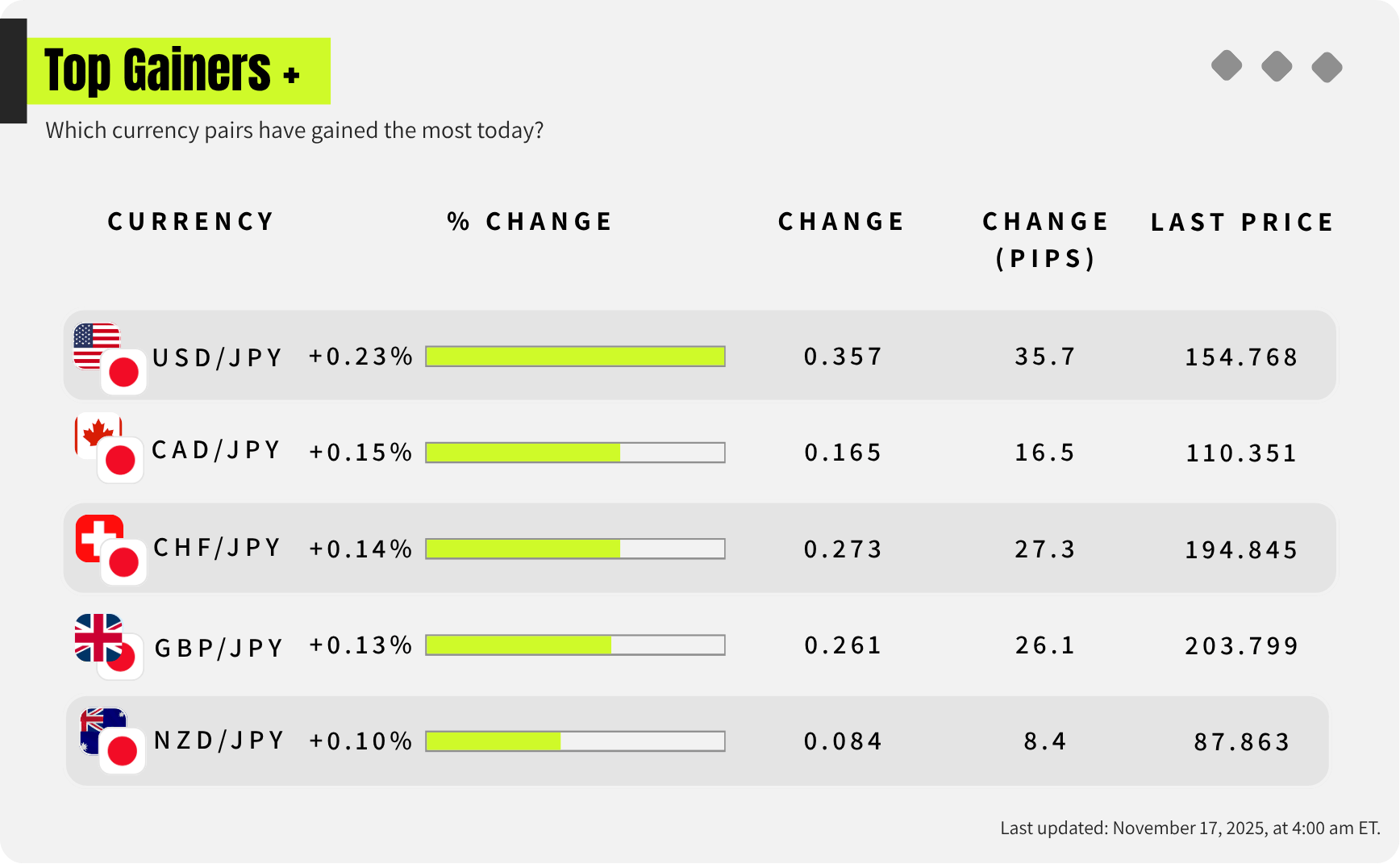

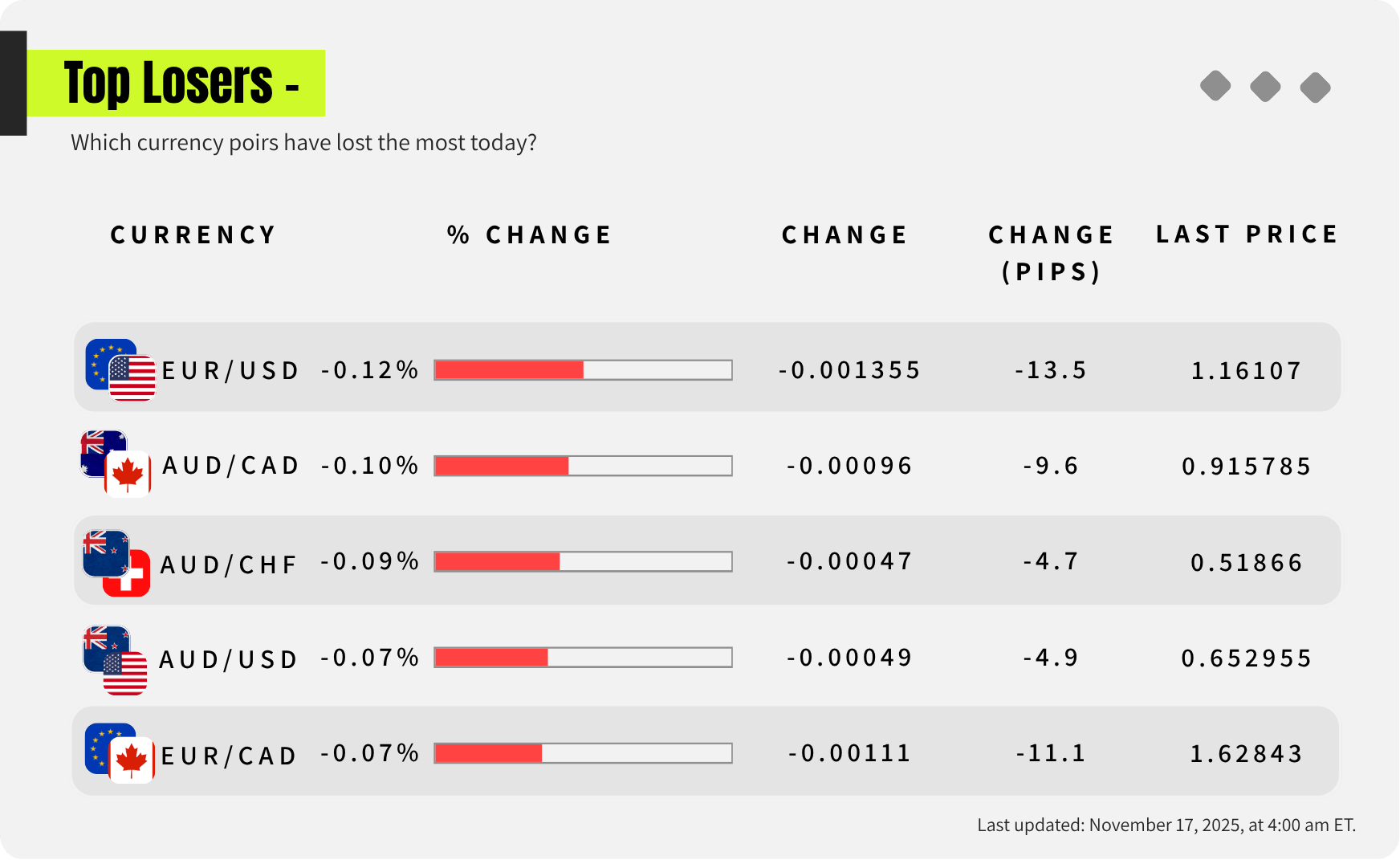

FOREX

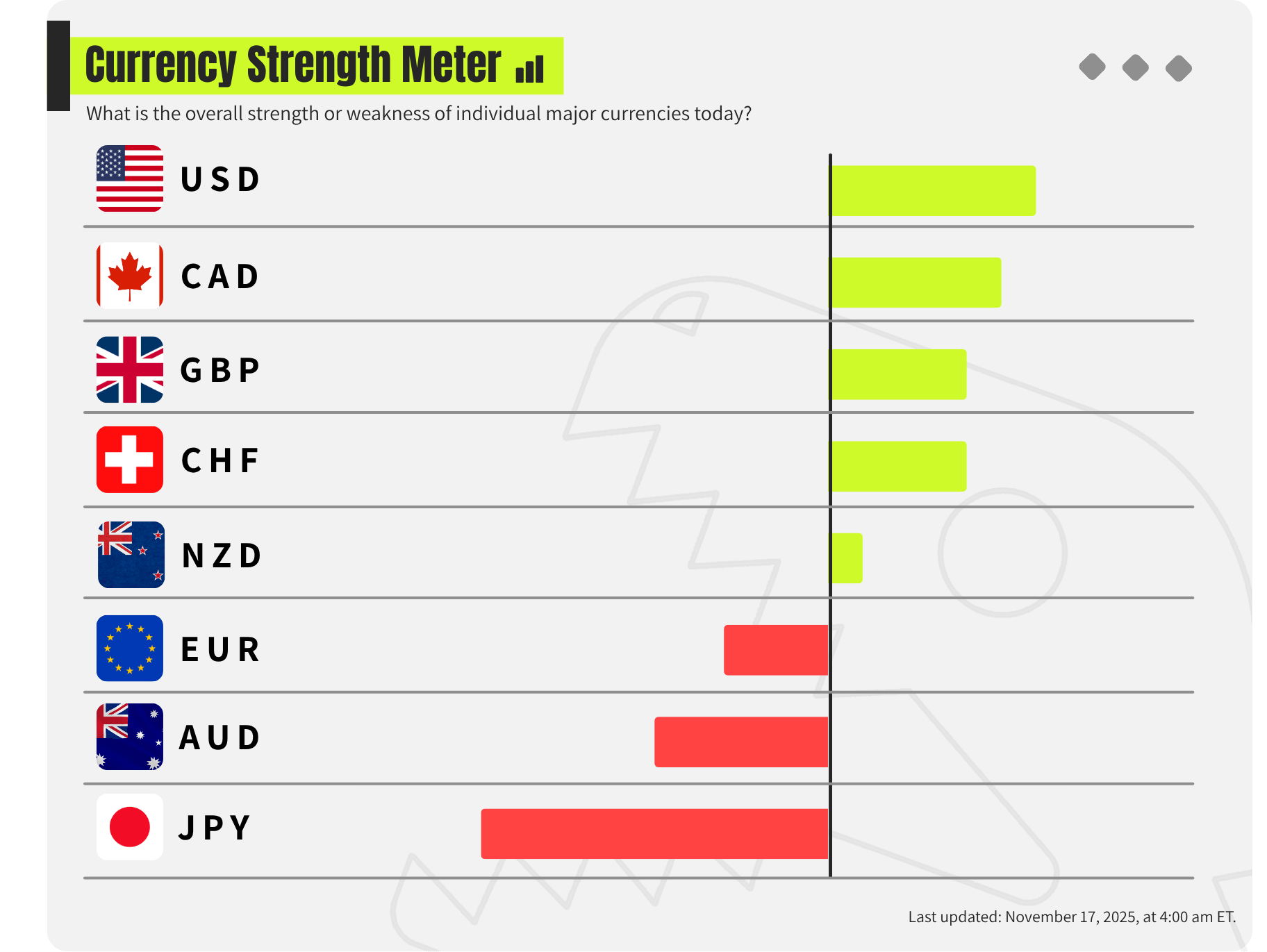

CHF Strongest, GBP Weakest

I feel like the market is on a knife edge this week, the fear and greed index is in the “extreme fear” zone and NVIDIA, the most watched AI company, will announce its earnings on the closing bell Wednesday.

This is all adding the fuel to the Swiss Franc and the United States dollar as risk off markets are finding support.

This is how the currency strength meter looks this week:

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

CHF: Markets switched back to the safe haven of the Swiss Franc last week, and it shows as it reaches +7 on the meter. In Switzerland the central bank is not likely to step in as they pursue a tariff deal with the US and would not want to rock the boat.

USD: Now the shutdown is over we could expect a little US weakness, but now attention will turn to back dated data and whether it gives us an insight into what will happen next. The CME fedwatch tool is now in favour of no cut.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

GBP: No changes here, the UK unemployment rose to its highest levels since 2020 and GDP wasn’t much better. The UK now faces a real possibility of stagflation if the inflation rates do not improve over the next couple of months.

NZD: There is no improvement in the kiwi although a lower timeframe shows the currency gaining some strength. But from a swing trading perspective this currency is still on my list of weak.

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

GBPUSD | |

NZDUSD | |

GBPCHF | |

NZDCHF |

DAILY TRADING PSYCHOLOGY NUGGET

“Patience turns noise into opportunity.” Most traders get trapped reacting to every spike or dip, but the ones who wait let the chaos settle before making a move. When you stop chasing noise, the real setups start to reveal themselves.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 17, 2025)

credits: REUTERS/Issei Kato

Japan’s economy shrank 1.8% in the July-September quarter, the first contraction in six quarters, as export weakness hit manufacturing and households pulled back. The result is putting pressure on monetary policy and investor sentiment alike. (source:reuters)

GAMES

Trading Brain Training

“I rise when fear spikes, I fade when greed returns.

Traders run to me when the world feels uncertain.

I’m not a currency, but I move like one.

What am I?”

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Watch Professional Traders trade live in London

🦖 Understand how Market Makers work

🦖 Check out these recommended trading tools.

ANSWER

Answer: Gold $XAUUSD ( 0.0% )