Good morning. The FOMC statement used to be released in secret, traders had to infer rate changes by watching the Fed’s open market actions. It wasn’t until 1994 that the Fed began publicly announcing interest rate decisions.

So before then? Markets traded on vibes and detective work.

-Shaun A, Jonathan Kibbler, Jordon Mellor

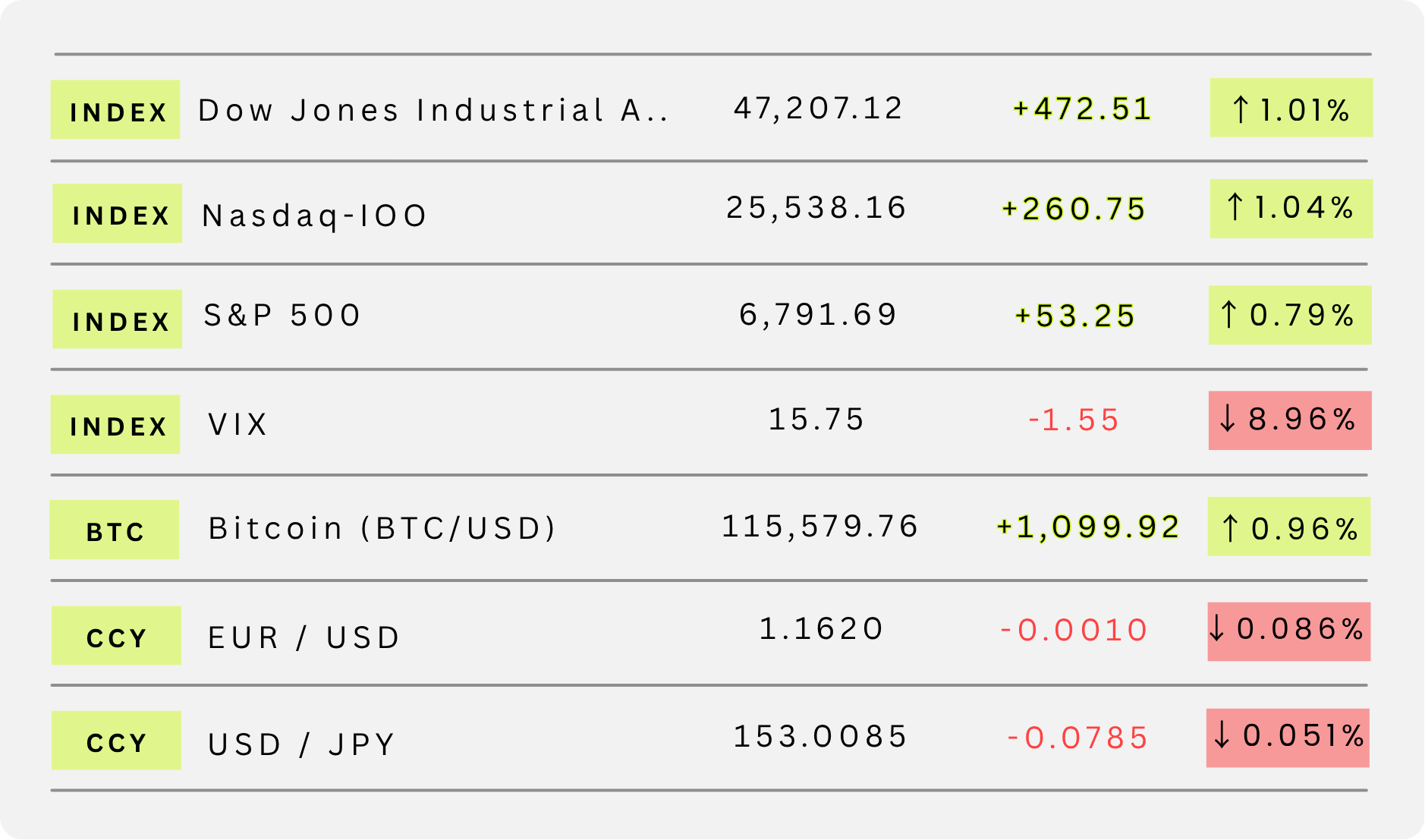

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

This Week, The Market Gets Serious

Last week was mostly noise. A few data drops, some positioning, a couple of fake breakouts that looked promising until they didn’t. Nothing truly committed.

But this week is different.

This week, the market either chooses direction or gets forced into one.

We’ve got Australia CPI, the Bank of Canada rate decision, and the big one “FOMC”

all packed into the same stretch.

If we’re going to get a real trend heading into November, this is where it begins.

Here’s What Matters This Week

1) Australia CPI – Wednesday/October 29

AUD pairs have been drifting in that awkward zone where nobody wants to pick a side.

CPI is the moment that forces commitment.

If inflation stays sticky, AUD can finally catch a real bounce, especially against JPY and USD.

If inflation cools, the slide continues and trend traders step back in.

Best play IMO is don’t guess early. Let the number hit, let the first spike pass, then play the follow-through.

2) Bank of Canada – Wednesday/October 29

Rates likely stay the same, but the tone is the trade. Canada’s economy has been slowing quietly. Households are stretched, business sentiment is fading, oil isn’t providing the usual floor.

If BOC sounds cautious, USD/CAD can drift higher.

If they show any concern about inflation sticking, CAD strength returns.

This isn’t a scalp event, this shapes direction for the next few weeks.

3) FOMC – Thursday/October 30

This is the centerpiece of the week. Powell doesn’t have to change rates to move the entire market. A shift in tone is enough.

If he leans toward more easing, USD softens and gold breathes again.

If he stays steady and patient, USD holds firm and risk pairs stay heavy.

My Takeaway

This isn’t the week to predict.

This is the week to watch closely, wait for the market to reveal where it wants to go, and act when it’s obvious.

We’re not here to guess. We’re here to respond.

Want to take advantage of the current bull run?

If you want to take advantage of the current bull market but are hesitant about investing, online stock brokers could help take the intimidation out of the process. These platforms offer a simpler, user-friendly way to buy and sell stocks, options and ETFs from the comfort of your home. Check out Money’s list of the Best Online Stock Brokers and start putting your money to work!

TRADER INSIGHTS

The Calm Before the Central Bank Chaos

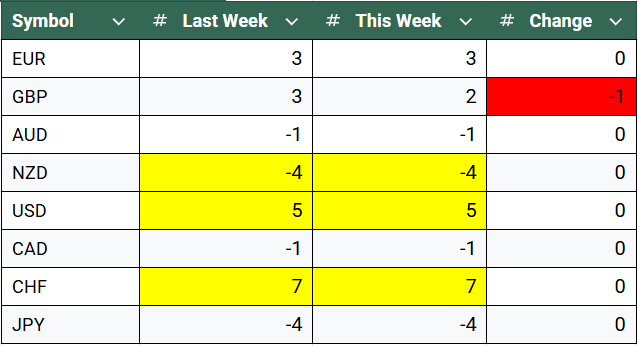

From a currency strength and weakness point of view there’s no change.

It all seems a little quiet in the markets.

Some may say it is too quiet.

In my experience that’s what can happen heading into a high impact news week.

We have four central bank decisions including the Federal Reserve.

Week’s like this can bring about a shift towards risk off markets.

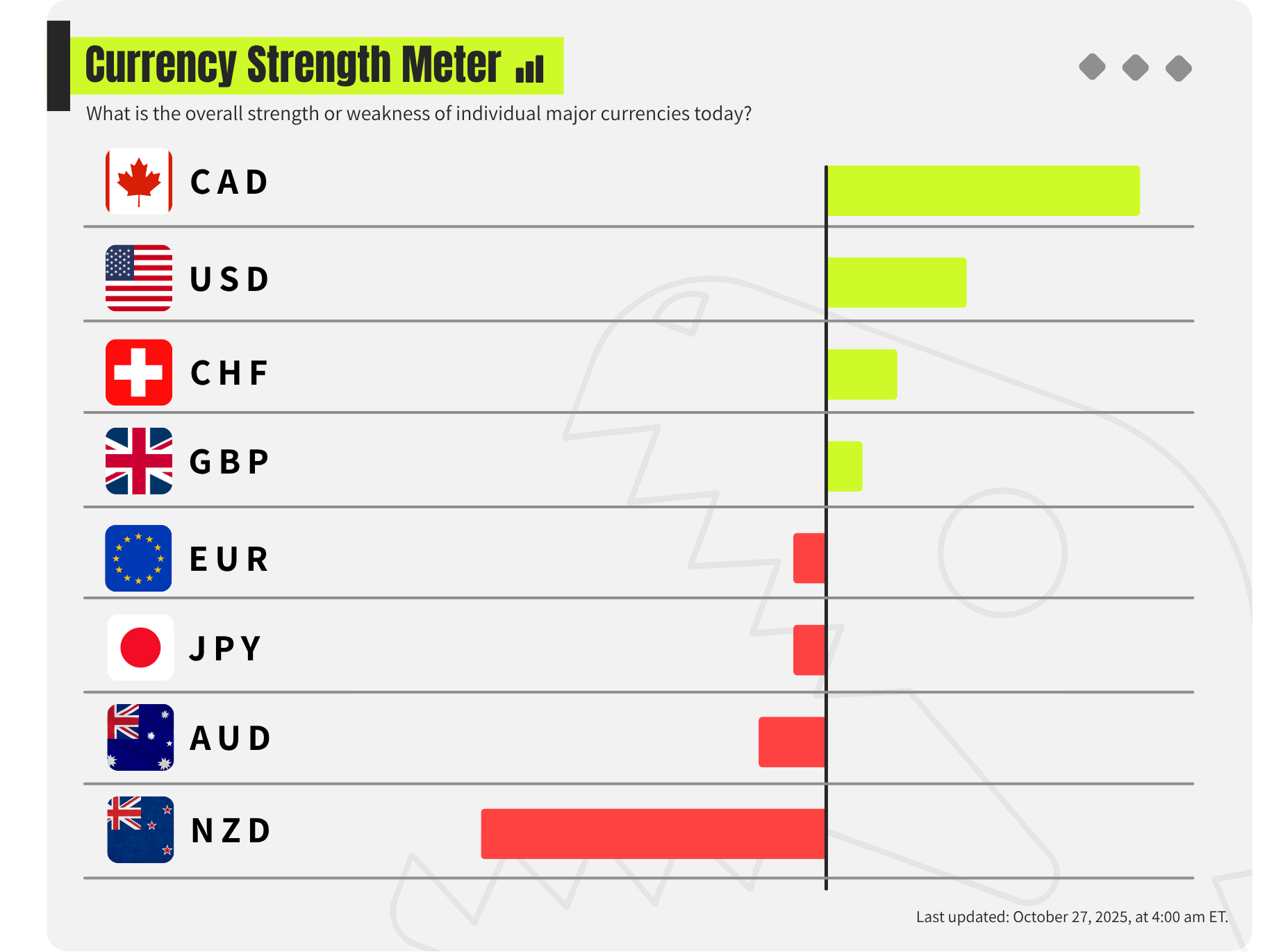

As it stands this is what the currency strength meter looks like.

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

CHF: No change for the Swiss Franc which tells us that the market is still not dipping its toe fully back into the risk on markets, despite some downside in gold last week.

USD: The greenback also remains strong. It will be a pivotal week as we expect a 25 basis point cut from the federal reserve but forward guidance has been a little murky. If Powell seems concerned about the economy and jobs in particular we may see USD weakness return as more cuts could come.

Weak Currencies

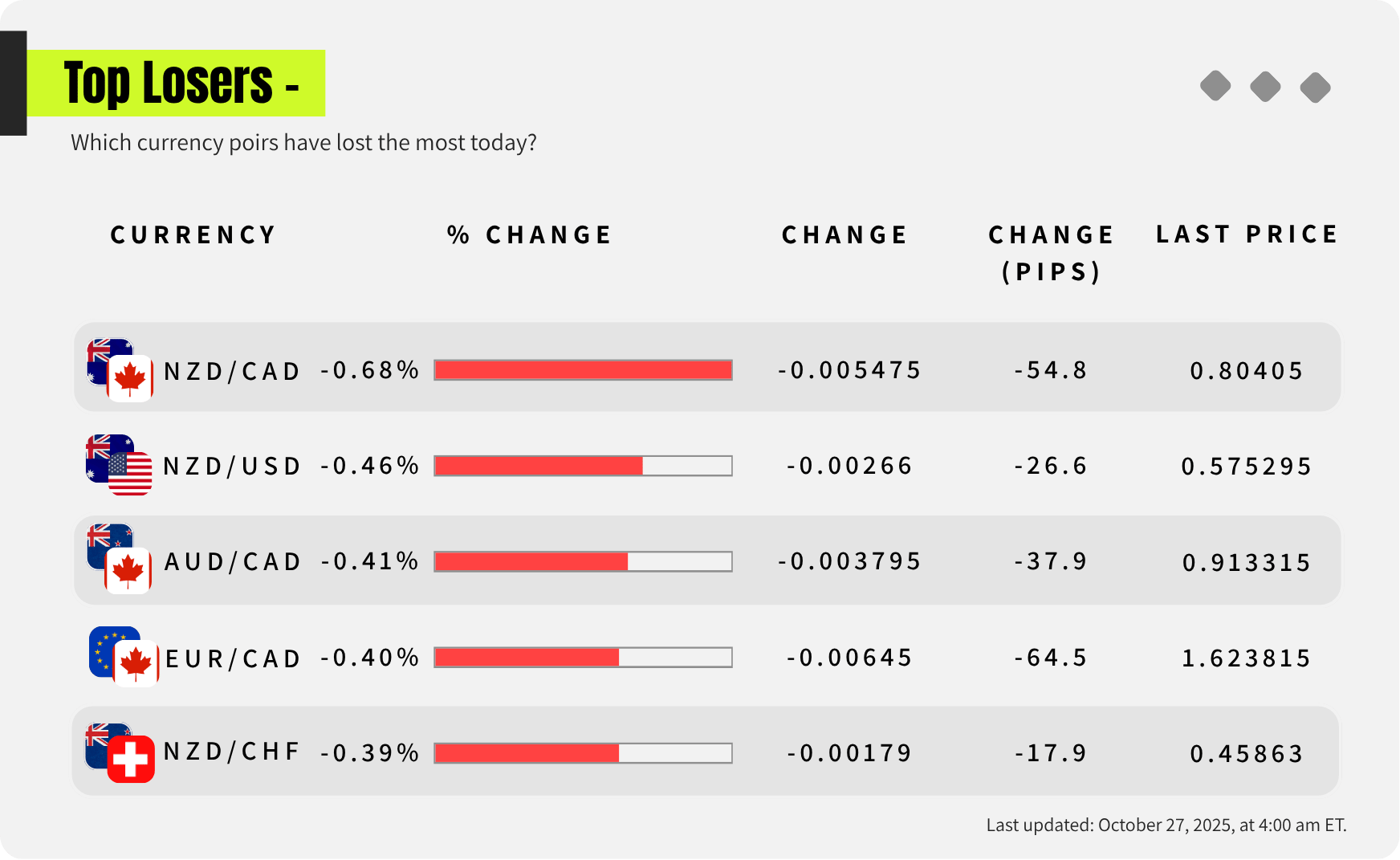

Looking at the opposite side of the strength meter now, these are the weakest of last week:

NZD: No changes here too the kiwi remains a weak currency and that looks likely to continue in the near term.

JPY: In Japan the currency weakened once more as oil prices spiked after new sanctions by the US on major Russian suppliers. If oil prices climb higher then the case for JPY weakness remains.

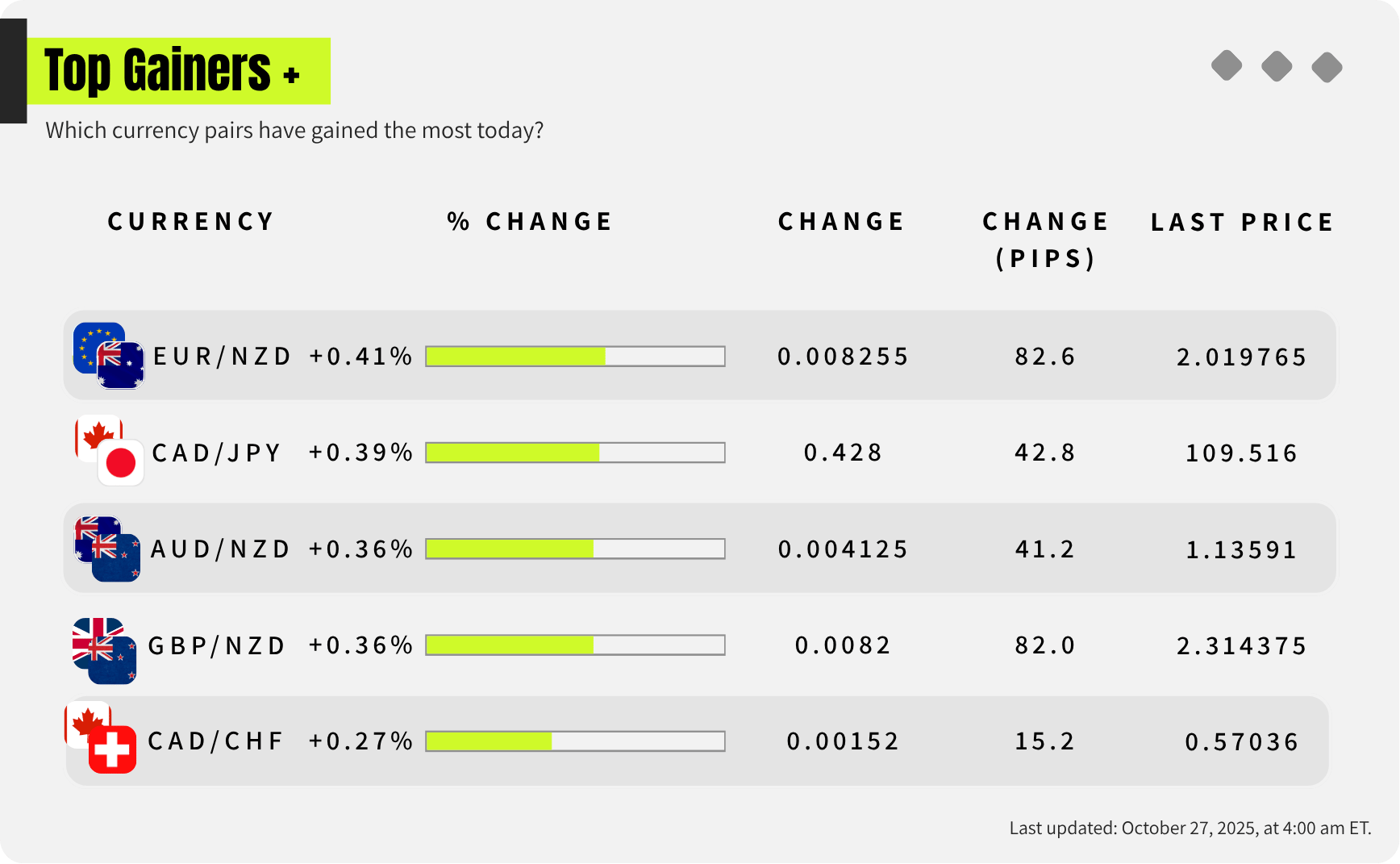

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

CHFJPY | NZDCHF |

USDJPY | NZDUSD |

CHART BREAKDOWN OF THE DAY (AUD/USD)

AUDUSD is trading around 0.6535, sitting just above rising trendline support. Resistance remains at 0.6550–0.6680, while support rests at 0.6415 and 0.6360. Momentum is mixed, price is holding structure, but upside remains limited unless buyers reclaim 0.6550 convincingly.

DAILY TRADING PSYCHOLOGY NUGGET

“Protecting capital is a skill, not a suggestion.” It’s easy to get caught up chasing gains, but the traders who last are the ones who guard their account like it’s their lifeline. If you focus on avoiding unnecessary losses, the wins take care of themselves.

TODAY’S MOST TRENDING MARKET NEWS (OCTOBER 27, 2025)

credits: Photographer: ipopba/iStockphoto/etty Images

Global stocks surged on fresh optimism over a nearly completed trade deal between the United States and China, driving risk-assets higher while the dollar held steady and futures contracts climbed ahead of upcoming tech earnings and the Federal Reserve meeting. (source:bloomberg)

GAMES

Trading Brain Training

I rise with fear and fall with ease,

A flight to safety if markets freeze.

Government-backed and steady in hand

When risk runs wild, I help you stand.

What Am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Check out these recommended trading tools.

🦖 Understand how Market Makers work

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: U.S. Treasury Bonds