Good morning. In 2010, a small trader named Navinder Singh Sarao made millions by “spoofing” the futures market, placing fake orders to manipulate prices, then canceling them before execution.

His trades from a London suburb were later linked to helping trigger the Flash Crash that erased nearly $1 trillion in minutes. One laptop, one man… global chaos.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

Trading Feels Different When It’s Real Money

It’s funny how the same setup feels completely different when the lot size changes. You can stare at the same candle, same structure, same plan but suddenly, when you double your position, your pulse doubles too. It’s not just numbers on the screen anymore; it’s your comfort zone on the line.

Here’s the thing: your position size doesn’t just affect your risk. It rewires how you think.

Here’s what you need to know:

1. The Illusion of Control

When you trade small, you see the chart clearly, structure, entries, exits, risk. You follow the plan. But once you size up, your mind starts looking for things; early exits, your running paper loss or gain, forced confirmations, imaginary signals. Suddenly, what used to be a clean read turns into a fight between fear and greed.

Bigger size doesn’t just increase exposure; it amplifies emotion. And that emotion starts to hijack logic if you don’t have strict parameters in place.

2. Confidence Is Leverage Too

Traders often say they “earned the right” to size up. That’s true but only if confidence grows faster than ego. When you’re trading within your tolerance, confidence is calm.

When you push beyond it, confidence becomes noise and every tick feels personal.

I’ve seen it countless times, got 1 friend who trades $1 per pip like a robot. LOL also another one who trades $10 per pip, this other trader suddenly can’t sit through a five-pip drawdown. I have also been in that situation so I understand well. Nothing changed except the emotion attached to the money.

3. The Math Is Fixed, But Your Mind Isn’t

A 1% risk is a 1% risk, whether it’s $100 or $1,000. But emotionally, those two numbers don’t hit the same. The math says nothing changed but your brain does. That’s why pros treat position sizing like a thermostat. When emotions rise, they dial it back, not because they fear losing, but to keep decision quality stable.

My Takeaway

Position size doesn’t just move your balance; it shapes your psychology. The best traders aren’t fearless, they’re emotionally calibrated. Every time you adjust your lot, you’re not just changing your exposure, you’re changing how you’ll think mid-trade.

Keep your size where your logic still speaks louder than your emotions. That’s your real comfort zone and your real edge.

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

MARKET ANALYSIS

Gold’s next move will depend on this.

This week’s 25 bps rate cut from the Fed is already priced in.

If you’re trading the headline you’re already late.

The real trade lies in what comes after the cut.

This FOMC meeting isn’t about what Powell does. It’s about what he says.

What Really Matters

The question out of this meeting isn’t “will the Fed cut?” it’s “will the Fed keep cutting?”.

Bond traders and the USD’s next move relies on this.

If Powell opens the door to more rate cuts than the two expected that’s bullish for gold.

Why?

Lower rates reduce the appeal of holding US bonds.

This can weaken the USD and put pressure on inflation.

However, if Powell sounds optimistic, suggesting he doesn’t see the need to cut rates further, that could be bearish and gold prices could continue its pullback.

What to Listen for in Powell’s Speech

It’s important to focus on the tone during the press conference.

If Powell sounds worried or cautious about the labor market, it suggests that the Fed is still biased towards easing.

On inflation, if he downplays inflation risks or calls them “well anchored”, it reinforces the same message.

That to me could be the catalyst that keeps the narrative we have currently, and in which could see gold trade higher.

Don’t react to the cut

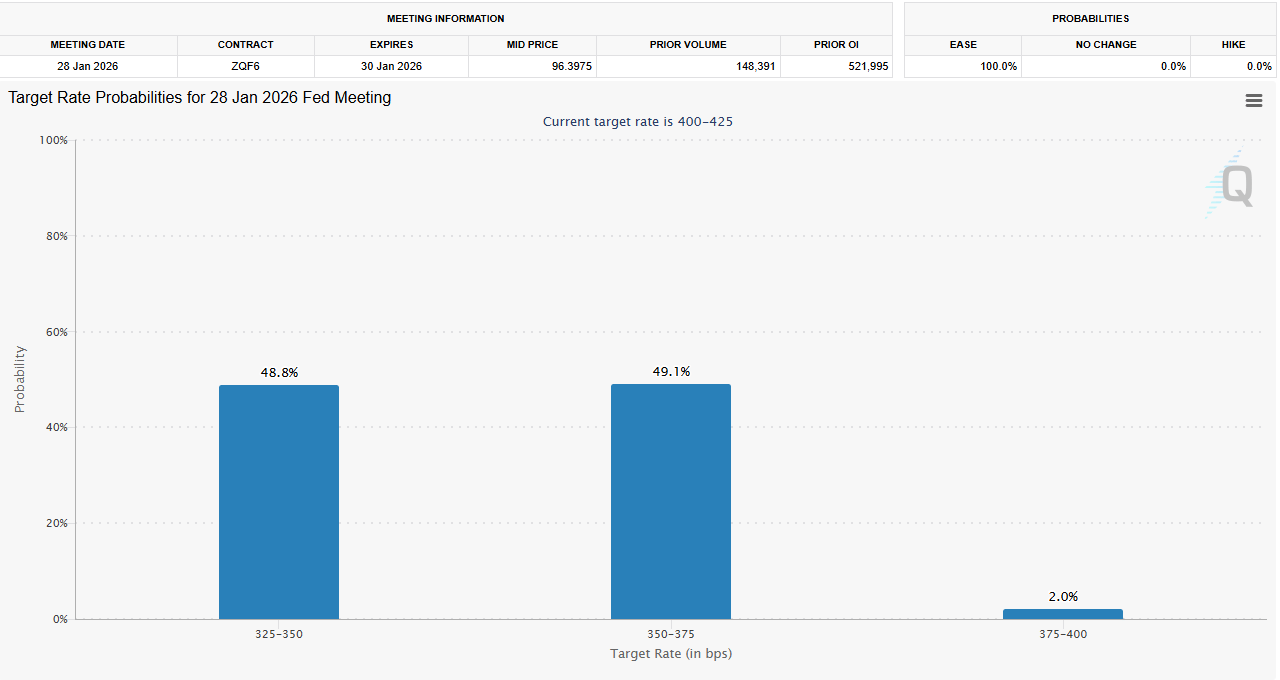

Look at the CME FedWatch Tool.

This is the January meeting probabilities. At the moment it is 50/50 between a hold or a cut.

After this week we could see this change, a skew towards a cut in January will be key as bond traders will likely buy to lock in higher rates, which will send yields lower.

In turn this will push USD lower and gold higher.

CHART BREAKDOWN OF THE DAY (USDCAD)

USDCAD trades near 1.3980, pausing after its latest climb from 1.38 support. The pair stays above the rising trendline, keeping a bullish bias intact, though upside remains capped at 1.4170–1.4450. A break below 1.3890 could hint at a deeper correction.

DAILY TRADING PSYCHOLOGY NUGGET

“Clarity comes after patience, not before it.” Most traders rush to act the moment the market moves, but real confidence comes from waiting until the setup is undeniable. The clearer the signal, the smaller the stress and the better the trade.

TODAY’S MOST TRENDING MARKET NEWS (OCTOBER 28, 2025)

credits: REUTERS/Willy Kurniawan

The US Dollar slid on Tuesday as markets turned more optimistic about a potential Donald Trump-Xi Jinping trade deal and awaited a string of major central-bank decisions. The dollar index hovered near 98.8 while the Euro hit around $1.1655, showing strength amid the easing risk aversion. (source:reuters)

GAMES

Trading Brain Training

I’m the dollar versus Asia’s sage,

Yields lift me, carry sets the stage.

Tokyo tweaks its yield-curve reins,

One headline, and I drop in flames.

What Am I?

GET TO IT

🦖 Understand how Market Makers work

🦖 Watch Professional Traders trade live in London

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Check out these recommended trading tools.

ANSWER

Answer: USD/JPY $USDJPY ( ▲ 0.01% )