Good morning. In 1999, a guy accidentally typed "b" instead of "m" and placed a $300 billion trade instead of $300 million. The market freaked out, and it became known as a “fat finger” error.

Lesson? Double-check your zeros, especially before caffeine.

-Shaun A, Jonathan Kibbler, Pat Lewis

MARKETS

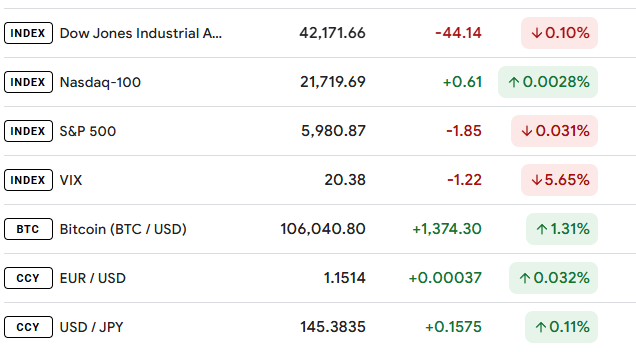

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

Oil Climbs as Middle East Conflict Deepens

Oil traders lit the fuse Thursday as headlines from the Middle East rattled markets again.

This time, Israeli Prime Minister Benjamin Netanyahu ordered a dramatic escalation of military strikes against Iran, sending crude prices surging.

Here’s what you need to know:

1. Israel Targets Tehran, Markets React

Brent crude jumped nearly 3%, closing at $78.85, its highest settlement since January 22. U.S. WTI wasn’t far behind, climbing to $77.20 at session highs. Why the spike? Israel’s military has been instructed to go after strategic targets in Iran, including those in the capital. Defense Minister Israel Katz made it clear: Tehran’s leadership is now fair game.

Markets aren’t just reacting to rockets, they’re pricing in regime risk. That’s big.

2. Trump Hints at U.S. Strike on Iran

President Trump poured fuel on the fire by telling reporters he’s considering a strike on Iran’s nuclear program. “I may do it, I may not do it,” he said in classic Trump style.

The White House says a decision will come within two weeks, but markets know one thing: even the talk of U.S. involvement can push oil prices higher.

3. Iran Hospital Strike Crosses a Red Line

The situation escalated further after an Iranian missile reportedly hit a hospital in Beersheba. In response, Katz issued a direct threat to Iran’s Supreme Leader, Ayatollah Khamenei. That kind of rhetoric isn’t noise, it’s a signal to energy markets that supply disruptions are becoming more likely.

4. JPMorgan Flags Regime Risk for Oil

JPMorgan’s global commodities head Natasha Kaneva warned that regime instability in a major OPEC producer like Iran could keep oil prices elevated for a long time. History backs that up, just look at Libya or Venezuela. Supply disruptions tied to political collapse tend to stick around.

Kaneva’s call? If Iran destabilizes further, prepare for oil to stay hot for a while.

5. Technical Levels Reflect the Heat

From a chart perspective, Brent is testing resistance near $79.00. A confirmed breakout could open the door toward the $82.00 region. WTI faces short-term resistance at $77.50, with support down at $74.20. Volatility is back, and it’s not going anywhere as long as war headlines keep coming.

Here’s the Takeaway:

Oil’s not just trading on fundamentals, it’s now a war trade. As long as Iran and Israel keep trading blows and the U.S. dangles intervention, crude will stay bid. Traders should buckle up for more geopolitical risk premiums.

Energy bulls are in the driver’s seat, for now.

SPONSOR

Investment picks returning 200%+

AIR Insiders get weekly expert investment picks and exclusive offers and perks from leading private market investing tools and platforms. So if you’re looking to invest in private markets like real estate, private credit, pre-IPO venture or crypto, the time to join FOR FREE is now.

TRADER INSIGHTS

Why No One Is Selling the Swiss Franc

The Swiss National Bank is beginning to run out of options; we will either see negative rates or intervention.

But only one will really move the needle.

Why the cut?

Swiss inflation fell into the negative in May (-0.1%), due to the Swiss Franc’s strength lowering import prices.

The European haven currency has surged against the USD this year as market uncertainty continue to plague headlines. USDCHF is down just over 12% year to date.

It was also reported by Reuters that the SNB flagged global economic fragility, directly correlated to trade risk in justifying the cut.

They have avoided cutting into negative rates, but it will only be a matter of time before they make it there again.

If this does not prevent further deflation, then the SNB may have to intervene in the market.

After the announcement, the Swiss Franc continued to strengthen against the USD.

The price found resistance towards 0.8200 where previous volume was built earlier in the month.

If the price breaks through the supporting trendline, it could signal the price heading back down towards the lows of 0.8100.

What’s Next?

In the short term it looks like the Swiss Franc will remain strong, especially against the USD which has problems of its own. This is being supported by the external uncertainties surrounding trade and ongoing escalations in the middle east, which the US seems prepared to get involved in.

In the medium term the market may begin to sell Swiss Francs if the central bank dips its toes back into the negative. However, to me this seems inevitable, yet the market isn’t interested in selling the currency right now.

This tells me that sentiment really need to shift if I were to look to sell this currency. This could be in the shape of trade tariffs being reduced or taken away across certain countries, or escalations in the middle east dissipate.

However, right now, I can’t see these happening just yet.

Intervention could be the only card the central bank could play, but they are reluctant to act as the US President could deem this is ironically as market manipulation.

It’s not like he himself told the whole world to buy the dip.

Key Thoughts

Intervention seems unlikely but the central bank can’t be completely taken off the table.

Market sentiment really needs to shift back to the positive if we were to see some moves higher here.

The market is still bullish Swiss Franc’s for now even with the potential of cutting rates into the negative.

GAMES

Trading Brain Training

I'm backed by credit, but I’m not your friend in debt.

Swipe me wrong, and markets fret.

My strength can crush, my weakness can lift—

I’m the world’s reserve, a double-edged gift.

What Am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.*

🦖 Understand how Market Makers work.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: The US Dollar $USDOLLAR ( 0.0% )