Good morning. On March 9, 2020, global markets suffered “Black Monday II” as oil prices collapsed and pandemic fears surged. The S&P 500 dropped 7% at the open, triggering a circuit breaker halt within minutes.

It was one of those Mondays where the market didn’t just wake up slow, it woke up screaming.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

Quiet Start, Big Moves Coming

Today feels kinda slow and that’s normal for a Monday for us traders.

This is the kind of day where patience matters more than entries.

Let’s look at what’s coming up, and why it matters.

Here’s What You Need to Know

1. GBP Jobs Data on Tuesday

The UK will release its jobless claims report. If more people are losing jobs, it tells us the UK economy is slowing. That could make the Bank of England think about cutting interest rates sooner. So GBP may move, depending on what the numbers show.

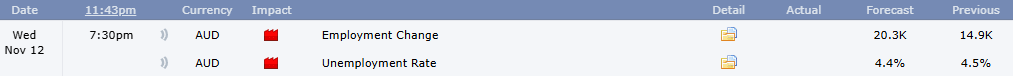

2. AUD Employment on Wednesday

Australia will release jobs and unemployment numbers. AUD has been moving because of market mood, not strong data. This report will show if the bounce was real, or just temporary.

Stronger jobs = AUD may rise

Weaker jobs = AUD may drop again

3. The Big One: U.S. CPI on Thursday

This is the most important event of the week.

CPI tells us how fast prices (inflation) are rising in the U.S.

If inflation is lower, the Fed may cut rates which means the dollar could weaken

If inflation is higher, the Fed may need more time which means the dollar could strengthen

Many pairs will wait until CPI before making real moves.

4. U.S. PPI & Retail Sales on Friday

These reports show how businesses and consumers are doing.

This helps confirm the story: Is the economy slowing because of job cuts? Or is spending still holding strong?

My Takeaway

Today is not about forcing trades. It’s about preparing for the moves that come later in the week. The market is quiet because many traders are for sure waiting for real information.

We don’t need to guess, we just have to wait for the data and react with clarity.

This week, timing will matter more than speed.

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

TRADER INSIGHTS

The Dollar’s Back in Charge and the Pound’s in Trouble

Well, the markets are on the move and some currencies have refreshed their strength and weaknesses.

As the US government shutdown continues and key data is released it is important to stay on top of the key markets that are moving.

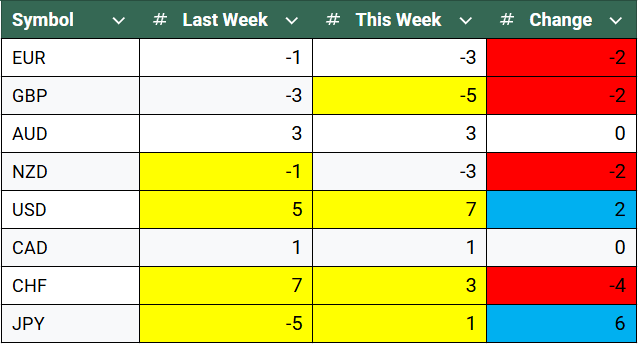

Here’s how the currency strength meter stands:

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

USD: The USD takes the top spot for now. Historically the longer the US shutdown goes on the weaker the USD gets, however we are in new territory now. The USD is strong and with stocks falling, if the CPI and PPI data this week comes in hotter it could play into this strength.

AUD: Taking a look at the Aussie, we can see that it is unchanged, but the currency is stronger then most after the RBA held rates and remained concerned over sticky inflation. Over the weekend we had stronger CPI and PPI out of China which could fuel some AUD strength.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

GBP: The British pound is now the weakest currency technically. The Bank of England held rates but the MPC showed a potential cut is coming. This week we see key employment and growth data released, if these show signs of weakness we could see continued downside.

NZD: The kiwi is a currency that continues to weaken. With the unemployment rate rising the RBNZ will be looking for another cut soon and this shows in the pricing across other currencies.

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

AUDNZD | GBPUSD |

NZDUSD | |

GBPAUD |

CHART BREAKDOWN OF THE DAY (EUR/USD)

EUR/USD is holding above 1.1395 support after breaking below its short-term trendline. Momentum remains soft, and buyers will need to defend this area to avoid a deeper pullback. A break below 1.1395 exposes 1.1190 and 1.1020, while reclaiming 1.1665 would help bulls regain control.

POLL

Next Chart Breakdown?

DAILY TRADING PSYCHOLOGY NUGGET

“Most of trading is waiting.” The move itself is quick, but the patience before it is where discipline is proven. Rushing to trade just to feel active leads to avoidable losses, while waiting for clear alignment sets you up to win with confidence.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 10, 2025)

credits: REUTERS/Brendan McDermid

Global shares jumped today as investor optimism mounted over a potential resolution to the U.S. federal government shutdown, lifting risk sentiment across equities while yields and the dollar edged higher. (source:reuters)

GAMES

Trading Brain Training

I’m not a pattern, but I mark the end,

Momentum fades, trends start to bend.

Lower highs or higher lows appear

My shift is subtle, but traders cheer.

What Am I?

GET TO IT

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

🦖 Do a super quick challenge that will have missive impacts on your results.

ANSWER

Answer: Trend Reversal