Good morning. In 1792, just 24 brokers signed the Buttonwood Agreement under a sycamore tree on Wall Street, agreeing to trade securities only with each other.

That simple pact grew into what we now know as the New York Stock Exchange.

-Shaun A, Jonathan Kibbler, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

MARKET ANALYSIS

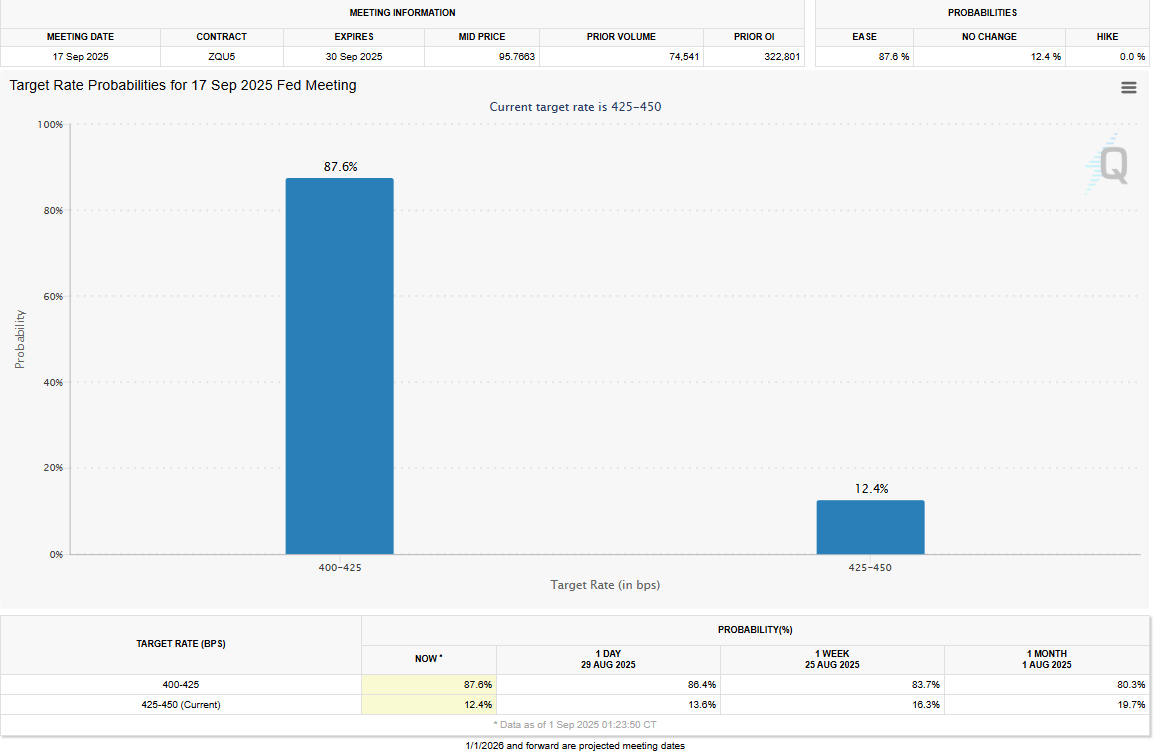

September Kicks off With Fed Cut Bets

The first trading day of September isn’t wasting time. After a summer loaded with tariff drama, Fed tension, and shaky economic data, markets open the month with one theme dominating: How soon will the Fed cut rates?

For me, this type of week is where patience pays. Mondays already bring slower flows, and when you layer in the anticipation of Friday’s NFP and Powell’s policy signals, it’s easy to get trapped by noise. I’d rather let the market show its hand instead of guessing early.

Here’s what you need to know and why it matters:

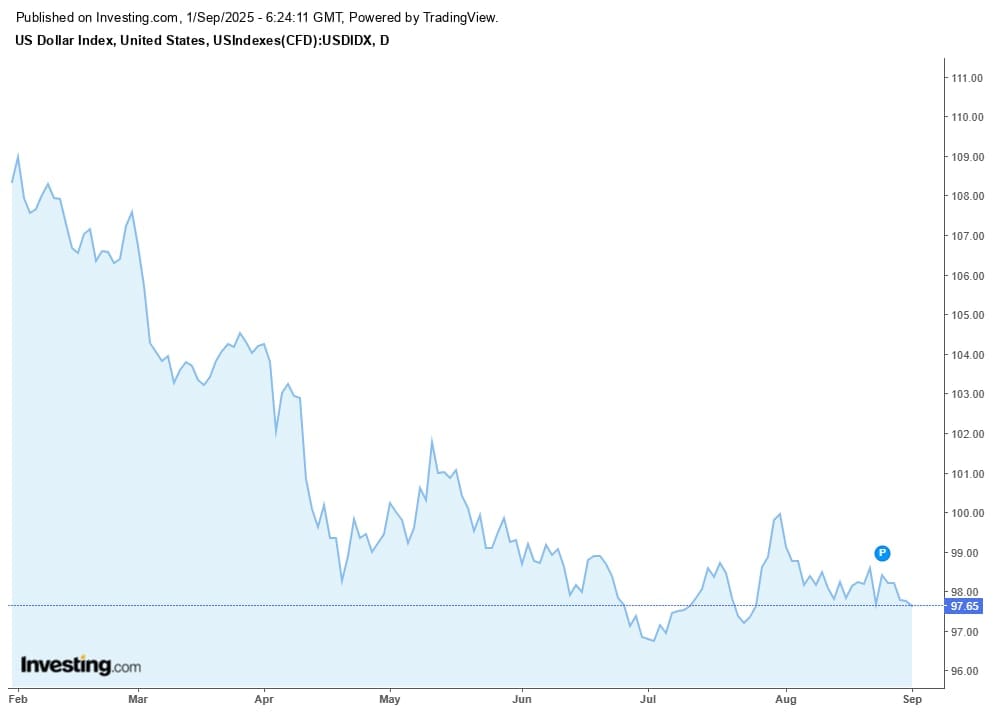

1. Dollar Still Holding Ground

2. Fed Cut Odds Are Rising

CME’s FedWatch Tool shows traders pricing in an 87.6% chance of a September cut. That’s the backbone of this week. If ISM or NFP miss expectations, those odds will solidify, and the dollar could finally crack lower. If the data surprises on the upside, the Fed may wait longer, giving USD another leg higher.

3. USD/JPY Stuck in Range

The pair sits near 146.80, caught between resistance at 148.50-150 and support closer to 146 and 145. It’s a classic range play right now. I’m not interested in guessing which side breaks first. A real move will come when the data and Fed guidance align until then, chop is just chop.

4. The Week Ahead Will Drive Sentiment

Tuesday: ISM Manufacturing PMI

Traders are looking for signs of recovery after last month’s weak print.Wednesday: Australia GDP and RBA

AUD will be put to spotlight, it could spill into cross flows.Friday: Nonfarm Payrolls

The main event. Jobs growth is expected to slow again, which would boost cut bets and put pressure on the dollar.

Here’s My Takeaway

September opens with the Fed at the center of everything.

For us traders, this is about not rushing. Dollar strength is holding for now, but that could flip fast if NFP comes in soft. Gold and EUR/USD will both feed off any cracks in the greenback. USD/JPY will likely be the clearest barometer of market conviction.

I’m treating this week as a waiting game. Big releases are lined up, and they’ll decide whether September starts with a break lower in the dollar or another round of resilience.

Until then, structure and patience remain my focus.

The Gold standard for AI news

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

FOREX

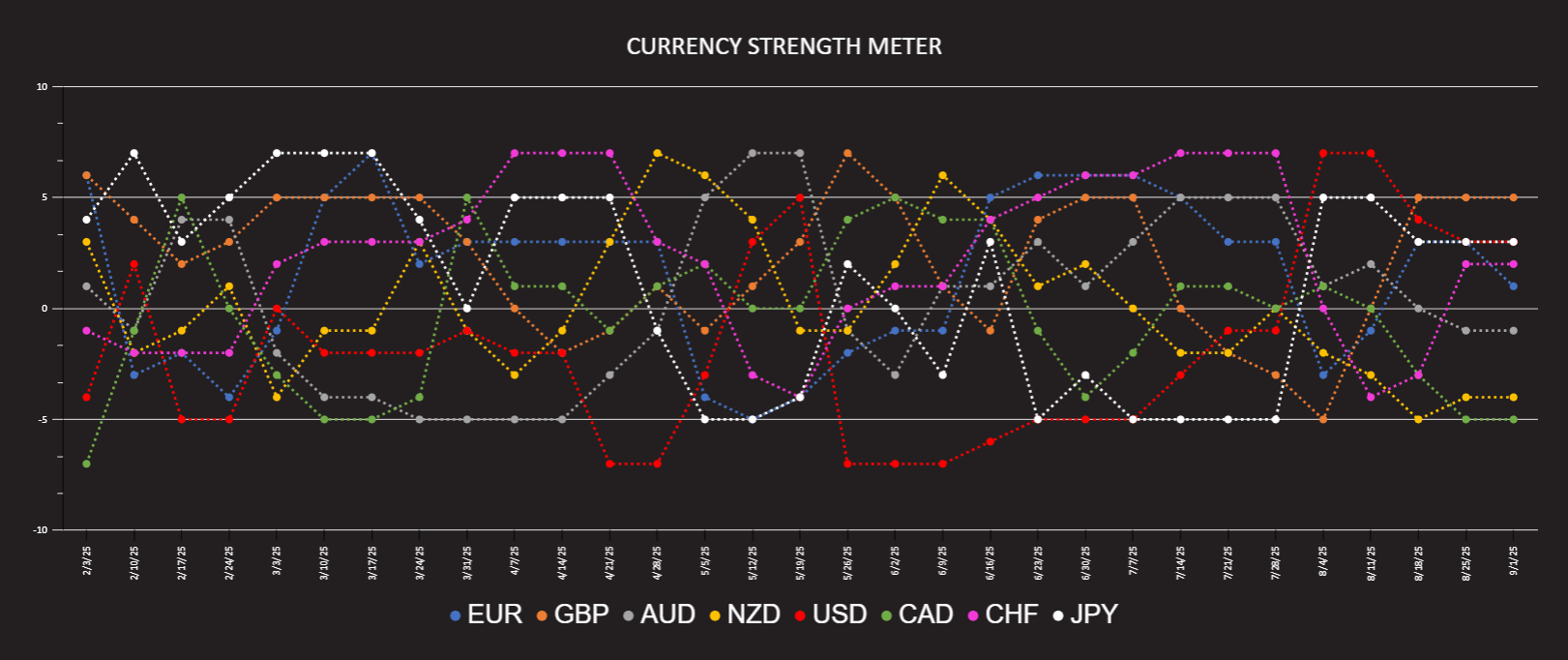

Currency Strength & Weakness for 1st September

Currency strength and weakness is a major part of my trading process. Let’s be real here, a trend forms one when currency is stronger than another. So my job is to find this out.

There are multiple ways to do this, we can analyse the fundamentals, which is something I do to find earlier opportunities, or we can use a currency strength meter.

To confirm:

Fundamentals: Identify global economies macroeconomic data points to see how a central bank may react. This is usually an early indicator of what may happen in the forex market.

Currency Strength Meter: Analyses the trends of the market to highlight which currency is strong and which is weak. This often requires the trend to form first and is considered a lagging indicator. But when a trend goes, it can go for weeks.

Let’s take a look at what to watch this week.

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

GBP: The British pound is the strongest currency at the moment at +5 and has been for the past three weeks. The Bank of England's chances of cutting rates have fallen sharply due to inflation pressures, and this is causing the GBP to remain strong for now.

CHF: The Swiss Franc has been gaining strength consistently for the past four weeks and is a market on my radar at +2. This is being driven by shaky fundamentals across the US giving a slight safe haven advantage to the CHF.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

CAD: The Canadian dollar is a weak currency at -5 and is where I would like to target for opportunities. Fundamentals aren’t great, the Canadian stock market is struggling and oil prices remain low.

NZD: One to watch for sure is the New Zealand dollar, this currency is very weak right now as the RBNZ is forecast to cut rates another two times.

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

GBPCAD | CADCHF |

GBPNZD | NZDCHF |

As always this doesn’t mean we just go to these markets and start pressing buttons. We need to add in other factors of confluence. But it’s a start for deeper analysis.

Good luck traders. Chat soon.

WATCH

Our First Funded Freedom Episode

GAMES

Trading Brain Training

I’m measured in pips, but I’m not a chart.

Leverage makes me bigger than my part.

Without me, trades can’t even start—

I’m the lifeblood that keeps markets smart.

What Am I?

GET TO IT

🦖 Understand how Market Makers work.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Liquidity