Good morning. Central banks are some of the biggest gold buyers in the world. In fact, countries hold over 35,000 metric tons of gold in reserves and the U.S. alone holds about 8,133 tons, most of it stored in Fort Knox.

Gold isn’t just a chart, it’s a policy tool. When confidence shakes, central banks don’t sell gold… they collect it.

-Jonathan Kibbler, Shaun A, Jordon Mellor

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

TRADER INSIGHTS

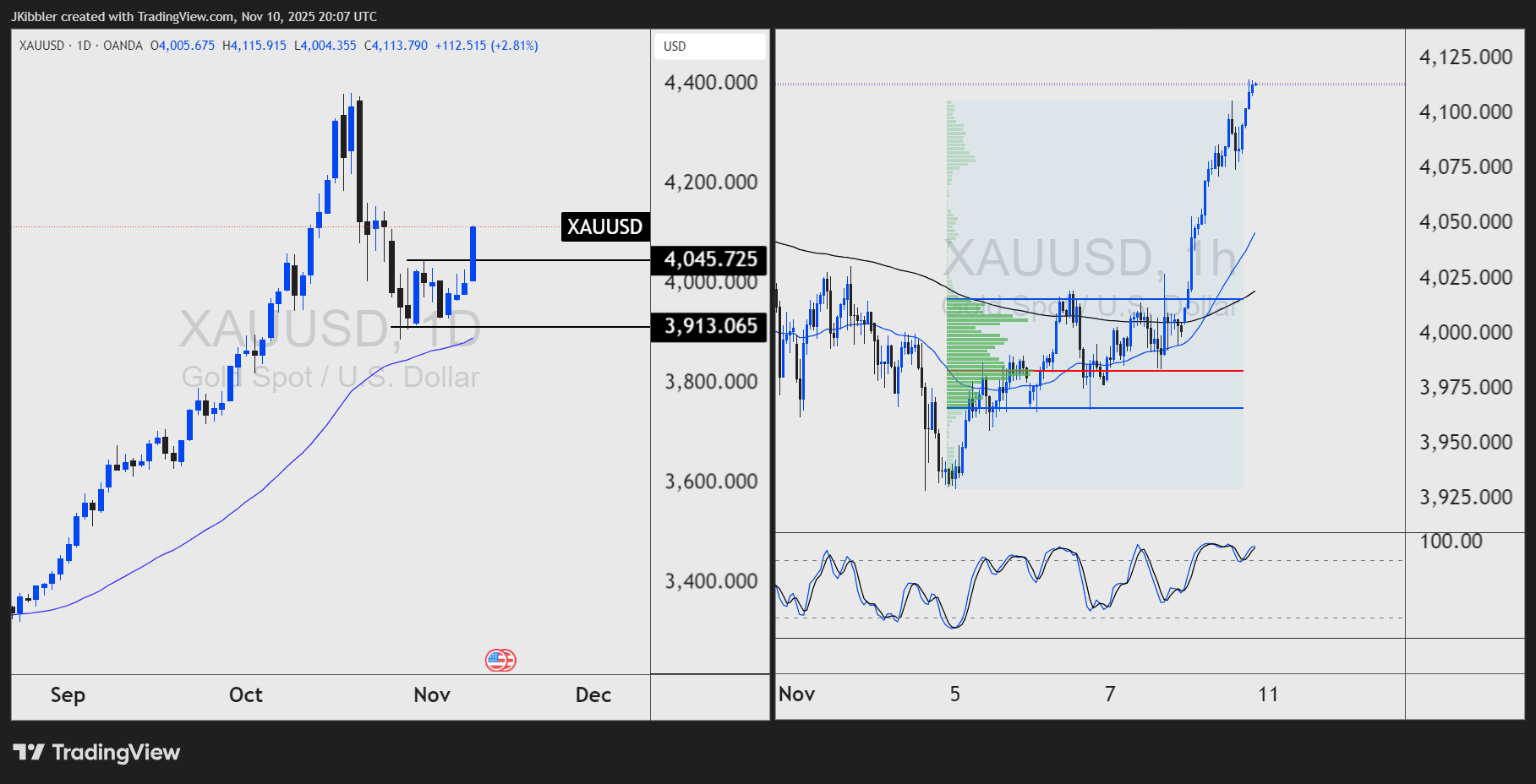

The Gold Rush 2.0. Here’s Why I’m Watching This Setup Closely

Gold prices are back in the spotlight.

The precious metal climbed to a two week high already this week trading above $4,100.

This market has now come back on my radar and here is how I'm applying my W.C.S method to it.

W-Why is Gold Moving?

The “why” is all about interest rate expectations and fear.

Recent data shows cracks forming in the U.S. economy:

Job losses were concentrated in the government and retail sectors.

Layoff announcements are rising as companies tighten costs and shift toward automation.

Consumer sentiment just hit its lowest level in nearly 3.5 years.

Together, these factors pushed traders to assign a 67% probability of a Fed rate cut in December (CME FedWatch).

When markets start to price in lower rates, gold shines.

Why? Because gold doesn’t yield interest when cash and bonds offer less, holding gold becomes more attractive.

Even the U.S. government shutdown drama has added to uncertainty, which fuels the bid for gold. Once that risk fades, focus returns to the Fed and the Fed looks ready to ease.

Conditions of the Market

The daily chart on the left hand side has broken through into new highs above $4045.00.

Price remains above the 50 period daily moving average.

On the hourly chart on the right hand side we can see the 50 and 200 moving averages have crossed bullish.

Strategy

Volume has been built between $4035 and $3970, this zone could offer a zone of support moving forward.

If the price dips back towards this level and forms a bullish rejection with the price closing above the 50 moving average I will look to buy the dip here.

Targets could reach up to the previous swing highs.

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

MINDSET

If You’re Bored, You’re More Likely to Force Trades

Let’s be honest, slow markets are uncomfortable.

Not because the chart is unclear, but because we don’t like feeling inactive. Hence the burnt accounts 😄 LOL

When price moves slow, your brain starts whispering things like:

“Maybe I should just take something…” “This setup is close enough…” “A quick scalp won’t hurt…”

And that’s the trap.

Boredom doesn’t push you toward good trades, it pushes you toward activity for the sake of activity.

Let’s break this down properly.

Here’s What You Need to Understand

1. Boredom Makes You See “Opportunities” That Aren’t Real

When nothing is happening, your mind starts dressing up average price movement as a setup. You start forcing patterns, forcing entries, and calling hope analysis. That’s not trading, that’s searching.

Familiar? Because most if not all traders have experienced that somehow

2. Forced Trades Aren’t About Strategy, They’re About Restlessness

If you need to justify or argue with yourself about the trade, it’s already wrong.

Real setups don’t need convincing. They punch you in the face, clean, simple, confident.

3. Patience Is Not Passive, It’s Skill

Every great traders you look up to? They trade less, not more.

They wait for the market to show intention. They don’t get paid for doing something,they get paid for doing the right thing at the right time.

4. Boredom Is a Signal, Not Permission

Feeling bored means the market is not ready.

No signal = no trade. Simple. The work is in respecting that simplicity.

My Takeaway

If you’re bored today, step away.

Don’t stare harder. Don’t “just take one.” Don’t try to manufacture something.

The market doesn’t reward effort. It rewards timing. Your edge isn’t how often you trade, it’s how well you wait.

If nothing is clear, nothing is required from you.

Just go breathe.

Come back when price is speaking again.

You don’t need more trades. You need better ones.

I say this from my 8 years trading experience and witnessing a bunch of traders doing the same thing.

CHART BREAKDOWN OF THE DAY (XAU/USD)

Gold bounced firmly from the $4,000 support zone and is now pushing back toward $4,155–$4,215. As long as price stays above $4,020 and the trendline holds, buyers remain in control. If momentum stalls at $4,215, expect a pullback but a clean break above this zone opens another run at $4,380.

POLL

DAILY TRADING PSYCHOLOGY NUGGET

“Your ego wants to be right. Your account needs you to be wrong quickly.” The moment you realize a trade isn’t working, the strongest move is to exit without hesitation. Protecting capital matters more than proving a prediction.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 11, 2025)

credits: REUTERS/Sarah Silbiger/File Photo

Federal Reserve officials are increasingly signalling a potential pause in rate cuts for the rest of the year as recent U.S. data show the labour market holding up and inflation staying above target. (source:reuters)

GAMES

Trading Brain Training

I’m not a price, but I show its pace,

How fast it runs, how strong the chase.

I fade when markets start to tire

But spike when moves catch sudden fire.

What Am I?

GET TO IT

🦖 Check out these recommended trading tools.

🦖 Watch Professional Traders trade live in London

🦖 Get funded as a trader with up to $4,000,000.

🦖 Understand how Market Makers work

🦖 Do a super quick challenge that will have missive impacts on your results.

ANSWER

Answer: Momentum