Good morning. In 2015, China’s surprise yuan devaluation shook global markets, triggering one of the sharpest one-day spikes in volatility that year.

It was a reminder that a single policy move from a major economy can ripple across currencies, commodities, and equities instantly.

-Jonathan Kibbler, Shaun A, Jordon Mellor

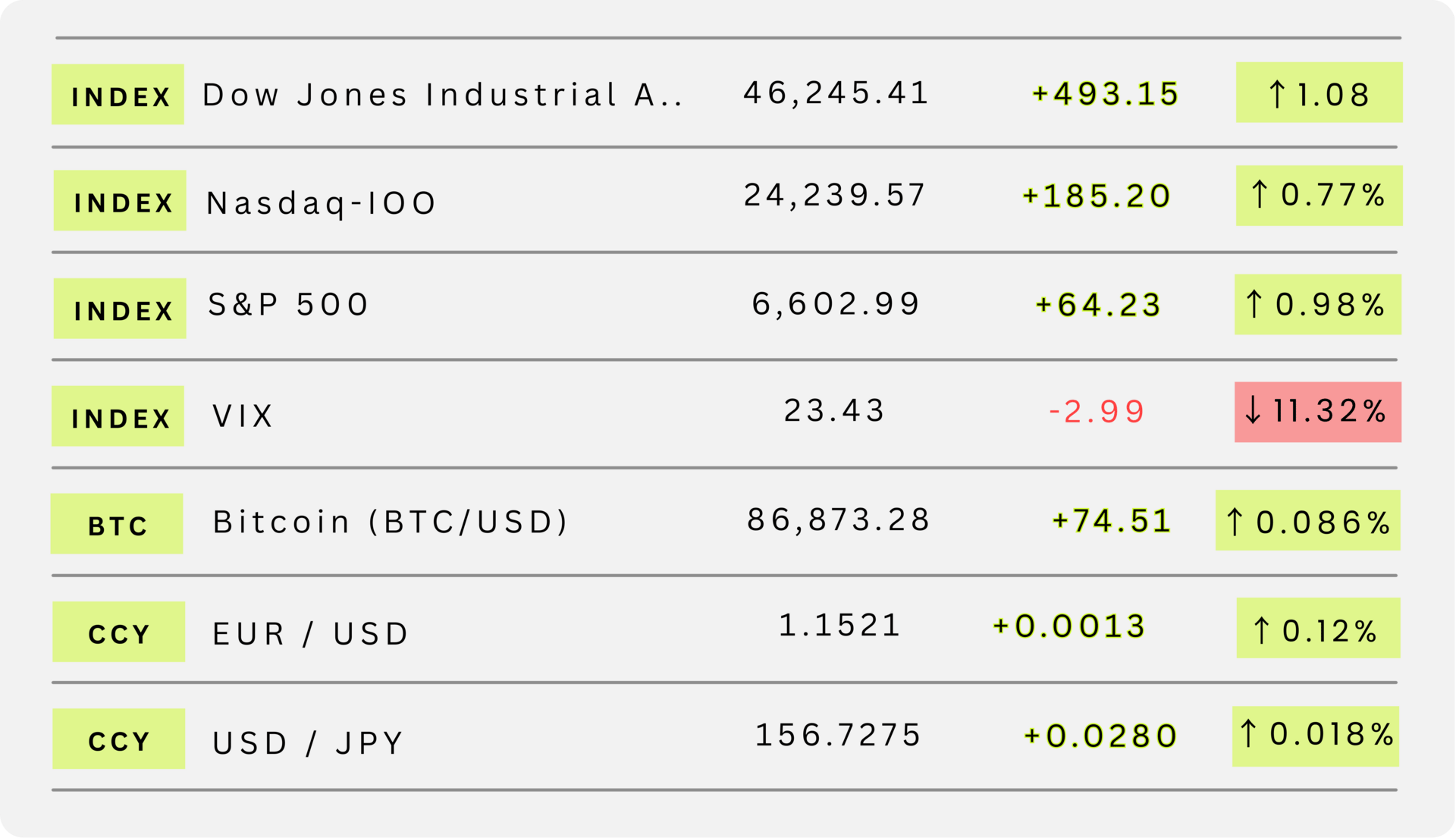

MARKETS

How’s your favorite today?

Prices supplied by Google Finance as of 4:00am ET - stock prices as of close. Here is what the prices mean.

GOLD CHART BREAKDOWN OF THE DAY

Gold is stuck in a tight squeeze today, trading right inside a triangle while riding the lower half of a broader range.

MARKET ANALYSIS

Don’t Get Fooled by Monday

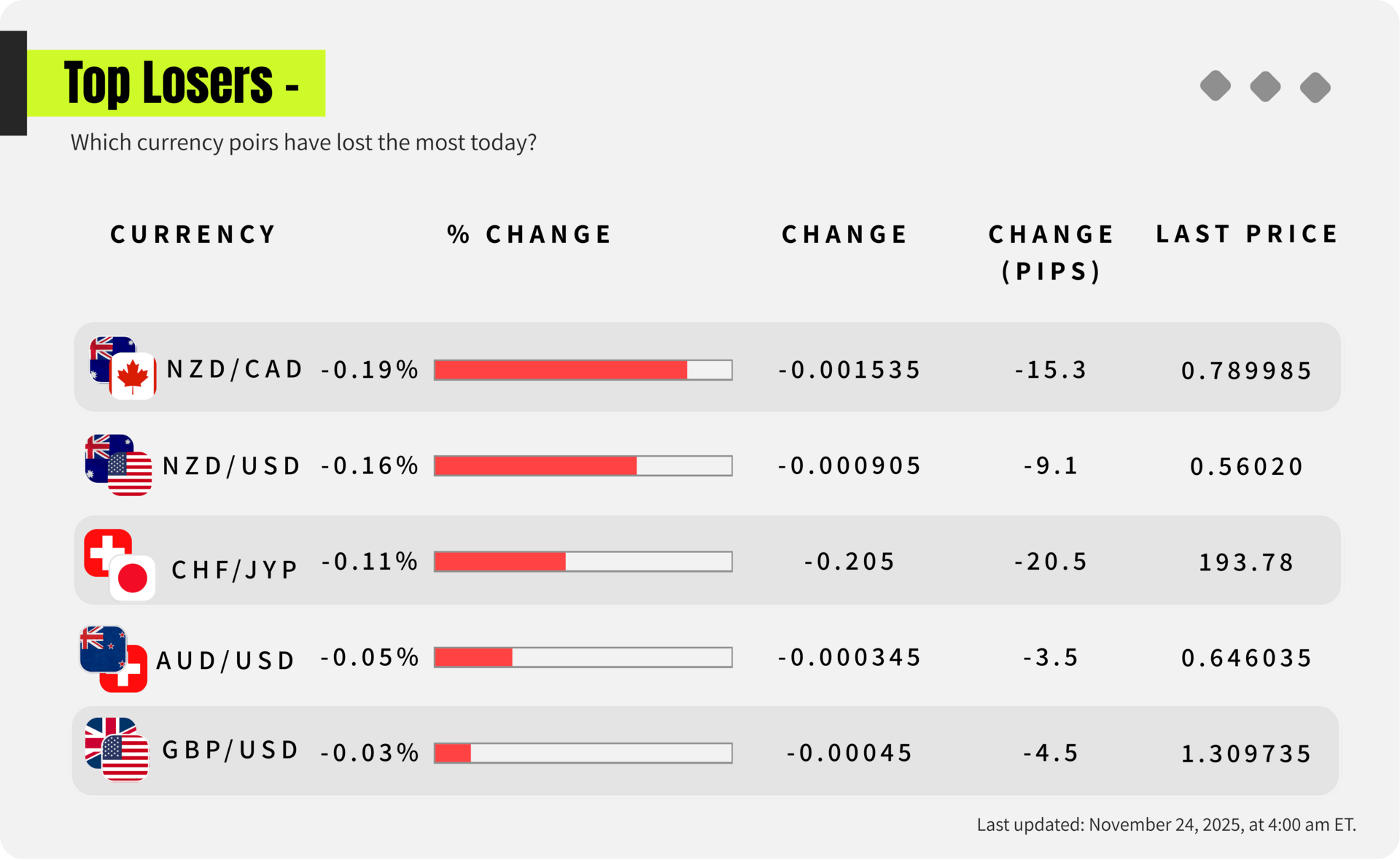

It’s one of those Mondays where the market looks sleepy… but it’s not actually sleepy. It’s hiding something.

When you have U.S. inflation data, NZD rate decisions, and the UK’s Autumn Forecast coming up all in the same week, Monday is never real. It’s just the calm before the charts actually move.

So don’t let the slow start trick you into thinking this week will be quiet, it won’t, never absolute. You never know.

Here’s what you need to know heading into the week:

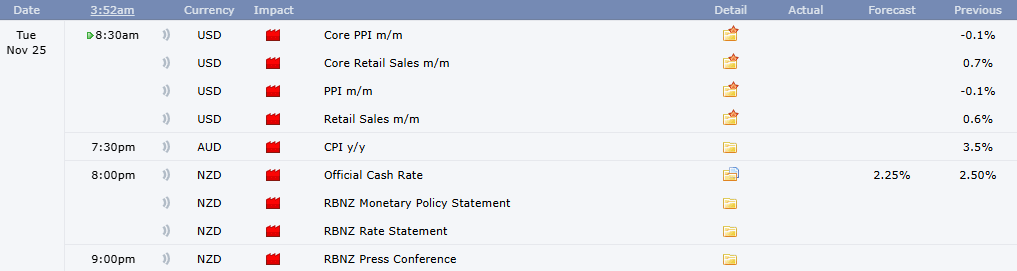

1. The USD’s Big Test Starts Tuesday

Core PPI, Retail Sales, and PPI all drop on Tuesday and these three can flip USD momentum immediately. We want clarity after weeks of mixed data. Hot numbers support the dollar; softer prints can break ranges fast.

2. NZD’s Most Important Day of the Month

The Kiwi faces a full event stack Tuesday night: Official Cash Rate, RBNZ Statement, and a live Press Conference. NZD has been weak, but any surprise in tone or forward guidance can spark aggressive moves across NZD/USD and the crosses.

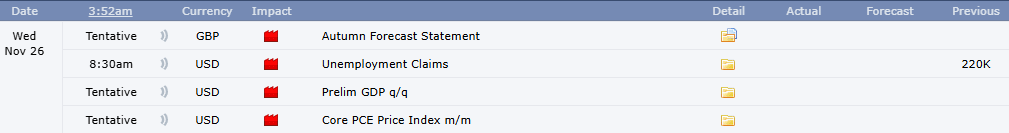

3. GBP & USD Collide Midweek

Wednesday brings the UK Autumn Forecast Statement and GBP reacts more to tone than data. Add U.S. unemployment numbers landing the same day, and GBP/USD becomes a two-sided battleground.

The follow-through continues into Thursday–Friday with Core PCE, which will confirm the USD’s direction for the rest of the week.

My Takeaway

This week is the type where one piece of data can flip sentiment overnight.

If you’re also trading today, let’s keep it simple: Watch ranges. Prep your zones and

don’t rush entries before the real catalysts hit.

The fireworks might not start today, but the preparation does and the traders who wait will have the advantage.

Put Interest On Ice Until 2027

Pay no interest until 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

MARKET ANALYSIS

USD & CHF Strongest as Markets Melt

It’s Thanksgiving week in the US! For those US subs I hope you enjoy your holidays.

For us non US retail traders this week brings some risks once again.

The two big events for me:

RBNZ interest rate decision.

UK leadership budget announcement.

These two events could shape the respective currencies for at least the next couple of months.

Data out of New Zealand lately has been surprising to the upside which could see the RBNZ begin to soften the tone on how dovish they have been.

From the UK side, the budget is expected to see a fresh round of tax increases which will likely impact the growth story in the UK for the future.

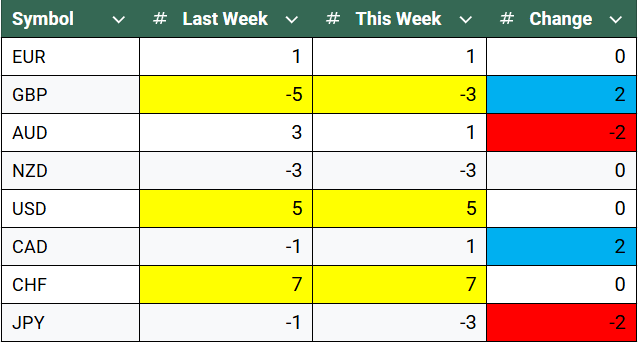

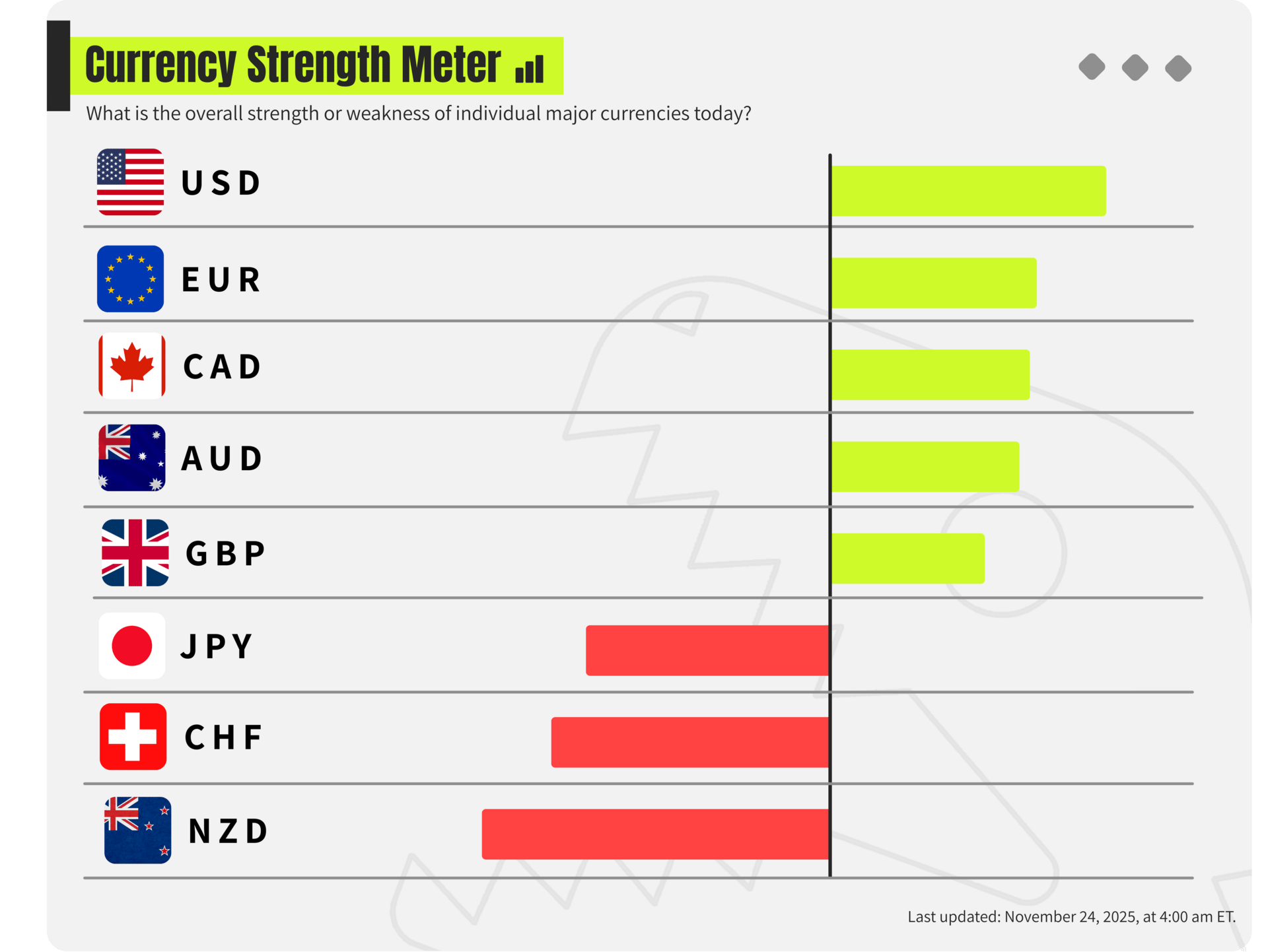

This is how the currency strength meter looks this week:

Strong Currencies

My currency strength meter highlights these currencies as the strongest as of last week:

CHF: With the market still in risk off mode the Swiss Franc has been supported, and with the market volatility rising it looks to be sustained for longer.

USD: A shorter trading week could see the USD weaken slightly, but that is yet to be seen across the board.

Weak Currencies

Looking at the opposite side of the strength meter now, these are the weakest of last week:

GBP: The British Pound remains under pressure across most currencies including the USD. If we see significant tax rises in the UK it could put pressure on the economy which is already struggling with growth.

NZD: If the RBNZ cut rates this week but discuss future guidance which looks less dovish the fortunes of the NZD could change, but for now it looks unlikely.

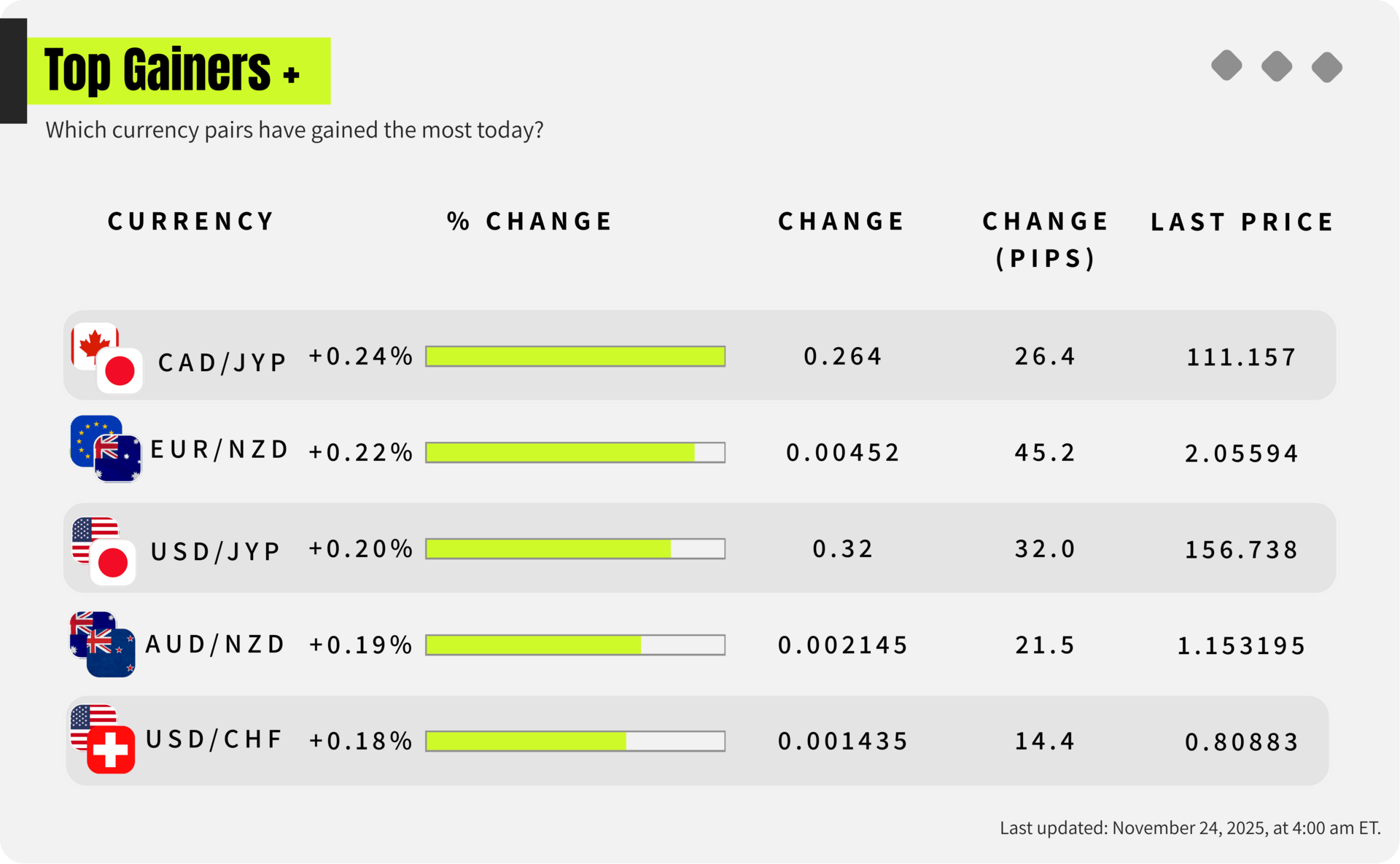

Markets to watch

Based off of the above these are the currency pairs on my trading watchlist:

Bullish | Bearish |

GBPUSD | |

NZDUSD | |

GBPCHF | |

NZDCHF |

DAILY TRADING PSYCHOLOGY NUGGET

“Your trading edge isn’t in predicting the move, it’s in managing yourself when the move comes.” Anyone can spot a setup, but only disciplined traders execute it calmly, size it correctly, and hold it without second-guessing. The real challenge isn’t the chart, it’s your reactions to it.

TODAY’S MOST TRENDING MARKET NEWS (NOVEMBER 24, 2025)

credits REUTERS/Francis Mascarenhas

Gavi and UNICEF secured a deal to reduce the cost of a new malaria vaccine by 25%, bringing the price down to $2.99 per dose, potentially funding 30 million more doses and protecting up to 7 million additional children in the next five years (source:reuters)

GAMES

Trading Brain Training

“I live just above highs and just below lows.

Price taps my zone, then snaps the other way.

Some call it manipulation, some call it fuel.

But without me, big players couldn’t fill their orders.

What am I?”

GET TO IT

🦖 Check out these recommended trading tools.

🦖 Get funded as a trader with up to $4,000,000.

🦖 Do a super quick challenge that will have missive impacts on your results.

🦖 Understand how Market Makers work.

🦖 Watch Professional Traders trade live in London

ANSWER

Answer: Liquidity / stop clusters (liquidity grab)